Economy: Global coronavirus cases have exceeded 46 million and the death toll has surpassed 1.2 million. The Covid-19 pandemic has entered its second phase after reopening of economies, revoking of strict social distancing measures, and increased mobility, where cases are again on an ascend. However, with advances in treatment and having gained experience, medical centers are better prepared to treat the ills as reflected by the low hospitalization rate and mortality ratios. Therefore, rather than a full-scale lockdown that brings economic and social life to a standstill, the response will rely mainly on strict but targeted rules for contact tracing, social distancing, and mask-wearing. In Pakistan, the number of new infection cases has also started rising with active cases surging to 14,000 from the lows of 5,500 in mid-September. However, we do not see another round of lockdown and significant disruption to the economic activity.

Economic activity has picked up steam after Coronavirus shock as reflected by the frequently released economic data such as power generation, cement dispatches, automobile sales, and retail fuel sales that have surged by 26%, 3%, 139%, and 14% during July-September 2020 compared with April-June 2020 period. Regarding external account, the country has posted current account surplus of USD 792 million in 1QFY21 versus a deficit of USD 1,492 during the same period last year. We anticipate the CAD to widen to a still manageable level of USD 4.4 billion (1.7% of the GDP) in FY21. Despite an elevated CPI reading recently, we anticipate inflation to moderate to 8% in FY21 compared with 10.7% in FY20. The SBP is likely to maintain the prevailing accommodative monetary policy regime in the near-term to support nascent economic recovery in the backdrop of a still-challenging global economic outlook.

Stock market: After surging by 57% from its bottom hit on March 25th till September 10th, despite stellar corporate earnings announcements, the stock market has come under pressure mainly driven by rising noise in the domestic politics and fear of the second wave of the Coronavirus. We view this recent market performance of the past few weeks as a healthy correction / consolidation as the investment landscape for equities is constructive shaped by improving economic prospects and attractive stock market fundamentals.

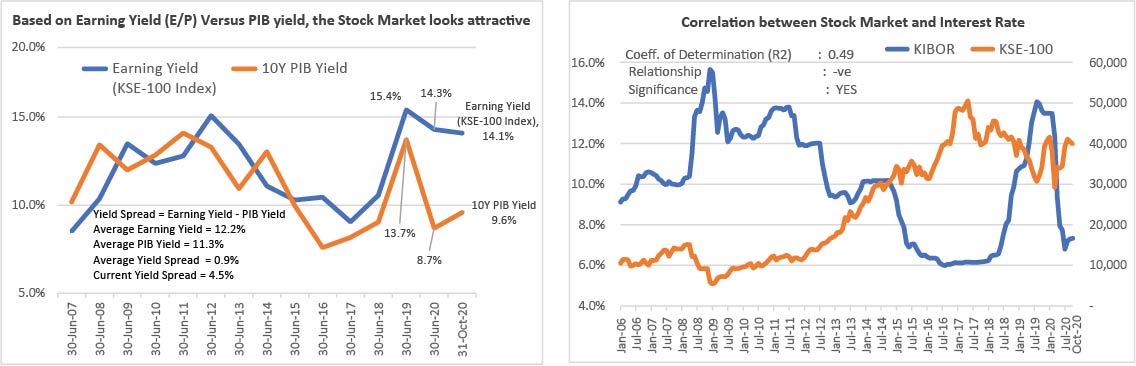

From the fundamental standpoint, the stock market is very attractive as captured by the forward Price-to-Earnings (P/E) multiple of 7.1x, versus 10-year average of 8.5x. On a relative basis, the Earnings Yield of 14.1% offered by the market also looks appealing compared with the 10-year PIB yield of 9.6%. The market also offers a healthy dividend yield of 5.6%. Corporate earnings, the key determinant of the stock market performance are expected to grow at a double-digit rate over the next two years. The market is trading at a Price-to-Book Value (P/BV) of 1x versus the 10-year average of 1.75x. The case for flow of funds towards equities has strengthened, considering paltry yields on the alternate fixed income avenues. Historical analysis shows that the stock market has performed well during the period of low interest rate and manageable CAD.

Bottom Line: The stock market holds potential to deliver robust returns in the medium to long-term given: (i) attractive stock market valuations; (ii) benign near-term inflation outlook and accommodative monetary policy; (iii) a healthy double-digit corporate earnings growth over the next 2 years; and (iv) fairly valued currency and manageable Current Account Deficit (CAD). With the fundamental story of the stock market intact, we advise investors with a medium-long term investment time horizon to consider investing in our stock funds, which have a track record of outperforming the stock market.