The SBP in its recent monetary policy meeting increased the Policy Rate by 150 basis points, and has hinted towards further tightening, which has taken the market by surprise. Not only the quantum of monetary tightening was steeper, it has also raised the Policy Rate expectations going ahead. Subsequent to the MPS announcement, inflation numbers also overshot the market consensus where the CPI has jumped to double digits, clocking in at 11.52% for the month of Nov-2021. The equity market corrected by around 5.5% post the MPS, before recovering slightly towards the end of the month, clearly reflecting uneasiness and uncertainty amongst the market participants.

The investors’ concerns on steepness of the hike and expectation of further tightening are rational given the inflationary pressures. Some investors are fearing that with rising inflation and interest rates, equities may underperform. However, we opine that this does not materially alter the investment case for equities, given the relatively inexpensive valuations.

We provide a historical perspective of the stock market performance versus the interest rates, which encompasses multiple market cycles involving both monetary easing and tightening regimes.

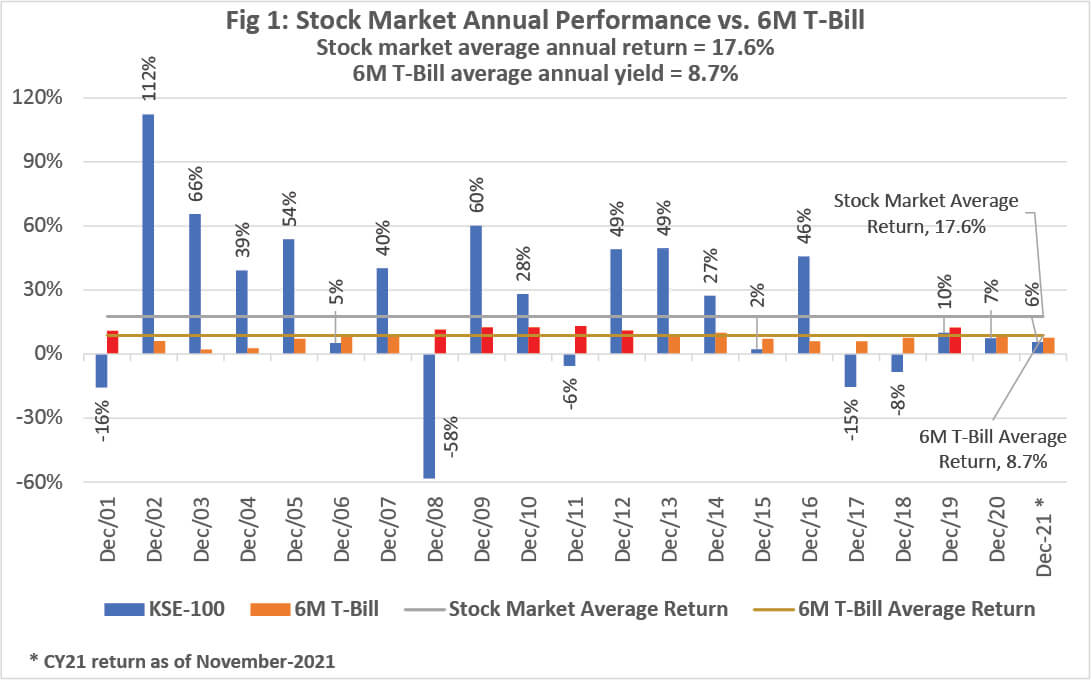

Market Cycles – Inflation and discount rate: Since 2000, the discount rate has averaged around 9.9% (Current: 9.75%), against an average annual inflation of around 7.7%. The stock market during the same period has grown at 17.6% per annum. During this period, the differential between earnings yield on the stock market and 6M T-Bills has remained close to 3.0%, which at present stands at a staggering 7.4%. This indicates the relative attractiveness of the stock market versus fixed income. Fig 1 depicts the annual stock market performance vs 6M T-Bills. On an average, stock market has outperformed 6M T-Bills by 8.9% per annum.

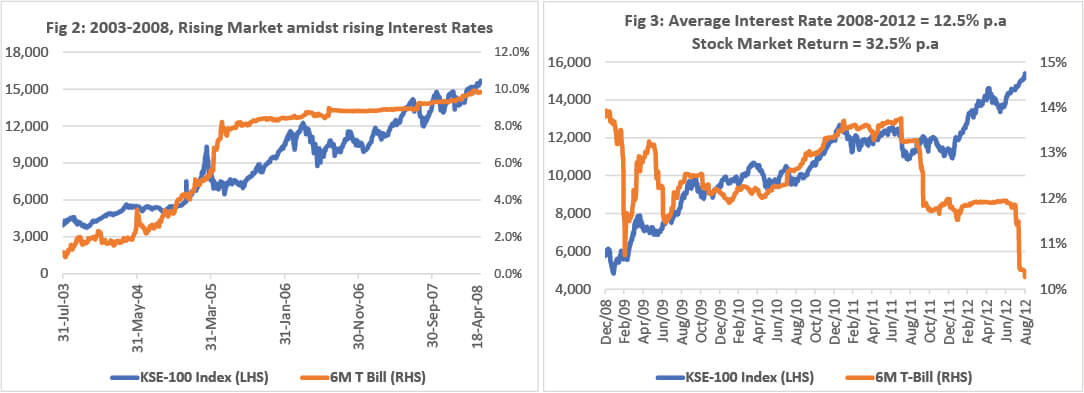

Fig 2 shows another interesting trend witnessed during the 2003-2008 period where despite rising 6M T-Bill yields (a jump of almost 900 basis points to 10%), the market posted a huge rally, rising by 300%. The daily data during this period yields a strong positive correlation of 0.9 between interest rates and stock market, a result totally opposite to common beliefs. This highlights the fact that several other factors, apart from interest rates, determine the performance of the market.

Some may argue that while the interest rates were on a rise from 2003-2008, they didn’t hit double digit where the actual impact on equities become visible. Fig 3 depicts another interesting phase of the market witnessed post the Global Financial Crisis of 2007-2008 where despite persistent double-digit interest rates of 12.5% (average 6M T-Bill rate from 2008-2012), the stock market yielded an average annual return of 32.5%. This was primarily due to the extremely attractive valuations, as market Price to Earnings ratio stood at 5.2x as of Dec-2008, which is fairly close to the present PE of 5.7x.

Conclusion and market outlook: If history is any guide, we have seen that historically amidst attractive valuations, rising and/or double-digit interest rates have not impacted the stock market performance to the extent believed by some market participants. Considering the extremely attractive valuations, the stock market is expected to offer returns that will more than compensate for the macro economic and political risks. We continue to advise our long-term investors to hold and/or build position in the stock market via our NBP Stock Funds. Our funds have historically outperformed the stock market by a good margin net of management fee and all other expenses.

Disclaimer: This publication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any fund. All investments in mutual funds are subject to market risks. The price of units may go up as well as down. Past performance is not necessarily indicative of future results. Please read the Offering Documents to understand the investment policies and the risks involved. NBP Funds or any of its sales representative cannot guarantee preservation – protection of capital and – or expected returns – profit on investments.