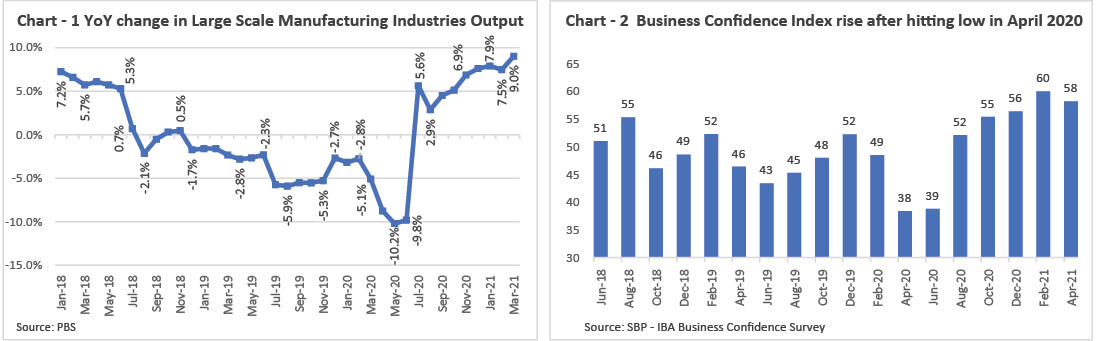

Pakistan’s economic recovery is on a firmer footing due to a relatively better containment of the pandemic and decisive policy measures undertaken by the fiscal and monetary authorities. The latest National Income Accounts data confirmed 3.94% GDP growth estimates for FY21 based on an estimated 2.8% growth in Agricultural, 3.6% in Industrial, and 4.4% in Services sectors, surpassing expectations of the government and the international financial institutions. The buoyancy in the manufacture sector is also corroborated by a hefty 8.99% increase in the overall output of Large-Scale Manufacturing Industries (LSMI) for 9MFY21 compared to the same period last year (see Chart-1). The recovery is also expected in the agriculture sector that has benefited from higher support prices and subsidies on fertilizers, bank credit and other farm inputs (seeds, tractors etc). As per the latest SBP-IBA Business Confidence Survey (BCS), overall business confidence remained in the positive zone for the 5th consecutive wave, though the Index decreased from 60 in February 2021 to 58 in April 2021 (see Chart-2). We expect continuation of economic growth momentum and anticipate GDP growth of 4.3% in FY22 driven by unleashing of the pent-up demand, strong rebound in manufacturing and services sectors, recovery in agriculture sector, and policy induced pick-up in construction activity. However, macroeconomic stability and sustainable economic growth entails painful yet necessary reforms of the economy such as privatization-restructuring of loss-making State-owned Enterprises (SOEs), deregulation of DISCOs, broadening of tax base, and rationalization of government expenditures, to name a few.

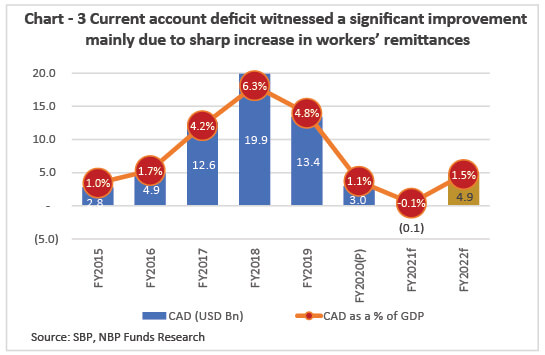

External account has improved significantly as a cumulative Current Account surplus of USD 773 million was recorded during 10MFY21, vis-à-vis a Current Account Deficit (CAD) of USD 4.7 billion during the same period last year. Much of this improvement in the Current Account owes to a staggering 29% year-on-year growth in workers’ remittances to USD 24.2 billion during 10 months of FY21. We expect the Current Account Balance (CAB) to post a surplus of USD 150 million (0.1% of GDP) in FY21 and anticipate a CAD of USD 4.9 billion (1.5% of GDP) in FY22. Helped by USD 2.5 billion borrowing through selling of Eurobonds and securing of IMF tranche of around USD 500 million under the Extended Fund Faclity, Foreign Exchange (FX) reserves of SBP have improved to USD 15.9 billion from USD 11.3 billion at CY19 end. The improving external account and market determined exchange rate regime adopted in 2019 have lent stability to the rupee that is trading near its fundamental value as determined by Real Effective Exchange Rate (REER) reading of 103.3.

Headline inflation as measured by the CPI spiked to 10.9% on a year-on-year basis in May 2021 after clocking in at 5.7% in January 2021. Key factors that stoked inflation recently were sharp increase in prices of perishable food items such as fresh fruits, vegetables, dairy, poultry, and edible oil and a quantum jump in electricity tariffs. We expect inflation to remain elevated in the coming months due to the low base effect. The inflation trajectory will depend on the path of domestic food and energy prices, any taxation measures in the upcoming budget, adjustment in the power tariff and retail fuel prices. Average inflation for FY20 stood at 10.8% and it is expected to clock-in at 9.0% in FY21. In line with the market consensus, the SBP left the Policy Rate unchanged at 7% in its bi-monthly Monetary Policy review in May 2021. More importantly, looking ahead, “the MPC expects monetary policy to remain accommodative in the near term, and any adjustments in the policy rate to be measured and gradual….” We expect a modest 0.5%-1% hike in the Policy Rate during CY21.

Regarding public finance, FBR’s revenue collection stood at Rs. 4.14 trillion in 11 months of FY21 against Rs. 3.53 trillion collection over the corresponding period last year, showing a significant 18% growth on a year-on-year basis. During 9MFY21, fiscal deficit has clocked-in at 3.5% of GDP due to high debt servicing cost, huge subsidy burden, and cash bleeding by loss-making Public-Sector Entities (PSE). For FY21, fiscal deficit is estimated at 6.9% of GDP after clocking-in at 8.1% in FY20.

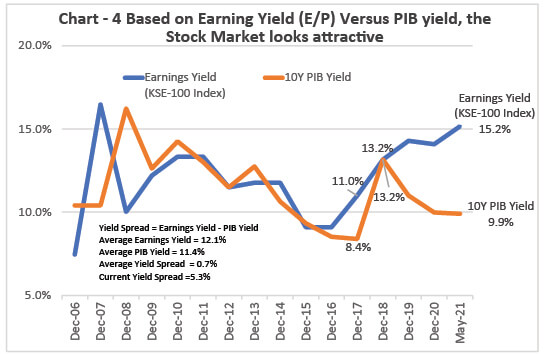

Stock Market: Rising noise in domestic politics and fear of another full-blown lockdown soured market sentiments that resulted in lackluster market performance during January-April 2021. However, confidence returned to the market after statements of Finance Minister, Shaukat Tarin for no new taxes and no power tariff hike in the upcoming budget; and 3.94% GDP growth estimates for FY21 released by the planning ministry. Resultantly, the benchmark KSE 100 Index surged by 3,634 points (a hefty gain of 8.2%) during May 2021. To put things into perspective, the market (KSE-100 Index) has surged by 39% during FYTD through May 2021 and it has delivered a remarkable return of 76% from its bottom hit in March 2020. Looking ahead, in our opinion, prevailing market valuations under-appreciate improvement on the economic and corporate fundamental fronts. Therefore, we see current market levels as good entry point for investors with medium to long-term investment horizon.

From the valuation standpoint, the market is trading at an attractive forward Price-to-Earnings (P-E) multiple of 6.6x, versus 10-year average of 8.4x. On a relative basis, the Earnings Yield of 15.2% offered by the stock market also looks appealing compared to 9.9% yield on 10-year PIBs. In addition to this, the stock market also offers a healthy dividend yield of 5.3%. Based on our estimates, earnings of the corporate listed sector are well poised to grow at double-digit rate over the next two to three years. We expect monetary policy to remain accommodative in the near term and anticipate a modest 0.5%-1% increase in the Policy Rate in CY21.

The Bottom Line: The market holds potential to deliver robust returns in CY21, and beyond driven by: attractive valuations as captured in the Price-to-Earnings (P-E) multiple of 6.6x; a decent double-digit corporate earnings growth rate expected over the next two to three years; and a healthy 5.3% dividend yield. Therefore, investors with medium to long-term horizon are advised to build position in equities through our NBP stock funds.

Disclaimer: This publication is for informational purpose only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell the fund. All investments in mutual funds and pension funds are subject to market risks. The price of units may go up as well as down. Past Performance is not necessarily indicative of future results. NBP Funds or any of its sales representative cannot guarantee preservation / protection of capital and / or expected returns / profit on investments.