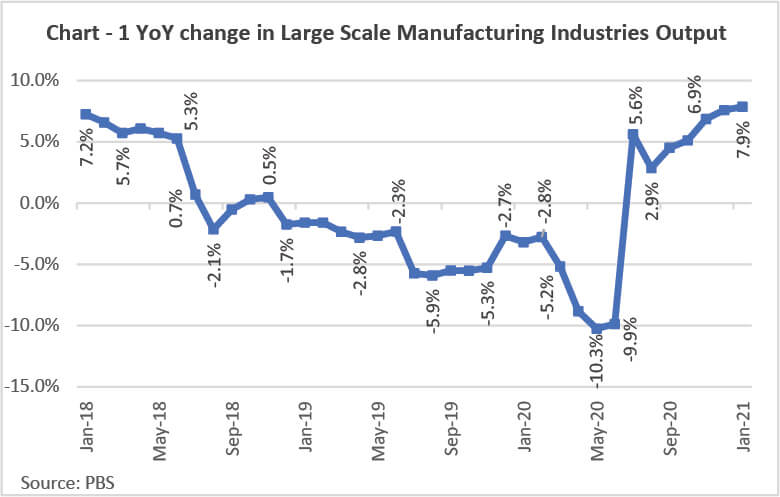

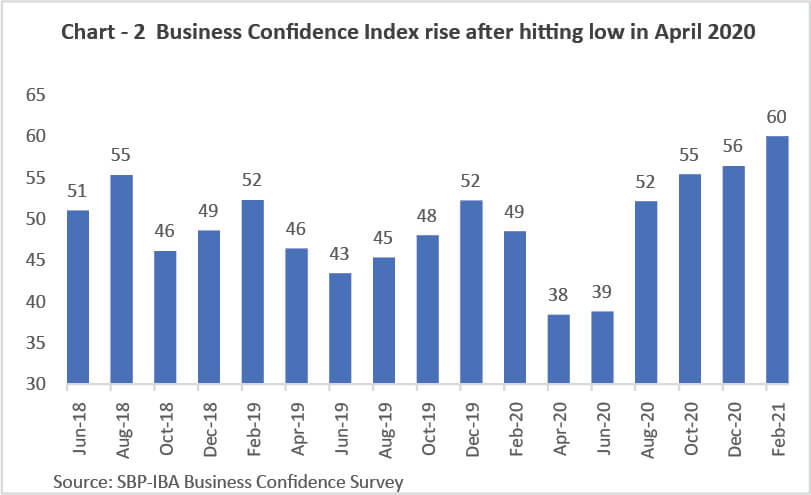

Pakistan’s economy is well on the path of a V-shaped recovery from the Coronavirus-induced contraction due to better containment of the pandemic and well-coordinated and decisive policy measures undertaken by the fiscal and monetary authorities. Frequently released economic data such as cement dispatches, automobile sales volume, and sales of retail fuel points to pick-up in economic activity. Buoyancy in the manufacturing sector is also corroborated by the output of Large Scale Manufacturing Industry (LSMI) that rose sharply by 9.13% YoY in January 2021, taking 7MFY21 growth to an impressive 7.85% (see Chart-1). Similarly, persistent upswing is observed in the business sentiment as SBP-IBA Business Confidence Survey shows the overall business confidence index increasing further to 60 in February 2021 from 56 in December 2020 (see Chart-2). After GDP contraction of 0.4% in FY20, we expect the economy to grow at 2.5% during FY21 driven by unleashing of the pent-up demand, strong rebound in manufacturing and services sectors, recovery in agriculture sector, and policy induced pick-up in construction activity. However, macroeconomic stability and sustainable economic growth entails painful yet necessary reforms of the economy such as privatization/restructuring of loss-making State-owned Enterprises (SOEs), deregulation of DISCOs, broadening of tax base, and rationalization of government expenditures, to name a few.

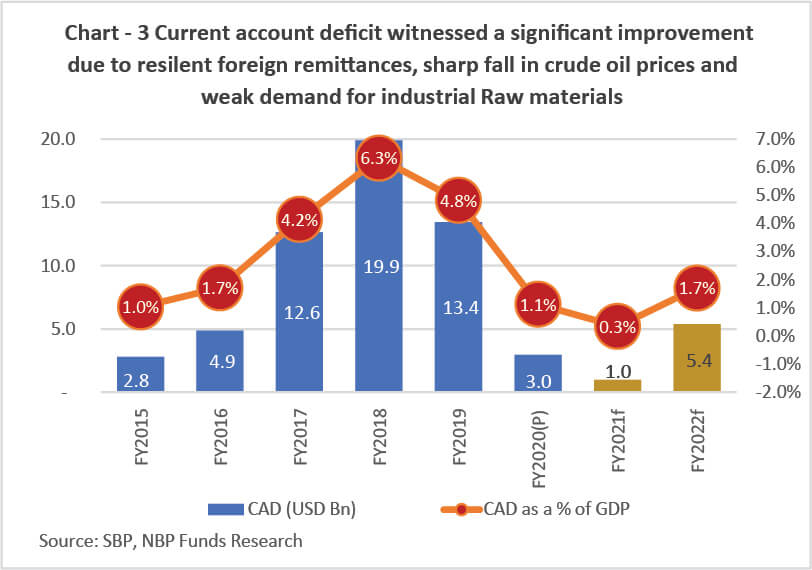

External account, the Achilles’ heel of our economy and key determinant of our stock market performance, has improved significantly thanks to a 24% year-on-year growth in workers’ remittances during 8MFY21. A cumulative Current Account surplus of USD 881 million was recorded during 8MFY21, vis-à-vis a Current Account Deficit (CAD) of USD 2.74 billion during the same period last year. We expect the CAD to remain at USD 1 billion for FY2021 (see Chart-3). The country has borrowed USD 2.5 billion by selling Eurobonds soon after the resumption of bailout program with the International Monetary Fund (IMF). The SBP has also received the IMF tranche of around USD 500 million under the Extended Fund Facility. With the revival of stalled IMF program, we also expect resumption of flows from multilateral agencies such as the ADB, IDB, and World Bank. The improving external account and market determined exchange rate regime adopted in 2019 have lent stability to the rupee that is trading near its fundamental value as determined by Real Effective Exchange Rate (REER) reading of 97.1.

Inflation as measured by the CPI spiked to 9.1% on a year-on-year basis in March 2021 after clocking in at 8.7% in February 2021 and 5.7% in January 2021. Key factors that stoked inflation in February were sharp increase in prices of perishable food items and a quantum jump in electricity tariffs. We expect further pick-up inflation in the coming months due to likely upward revision in the power tariff, low base effect, and some expected increase in retail fuel prices. Average inflation for FY20 stood at 10.8% that is expected to clock-in at 9.2% in FY21. Despite elevated inflation readings, the SBP has signaled the continuation of accommodative monetary policy, considering significant slack in the economy and mounting risks to the economic recovery emanating from the rising Coronavirus cases in the country. We expect a modest 1%-1.5% hike in the Policy Rate during CY21.

Large fiscal deficit run by the successive governments has led to build-up of public debt, thereby crowding-out private sector and imperiling debt sustainability. During 1HFY21, fiscal deficit has clocked-in at 2.5% of GDP due to high debt servicing cost, moderate growth in tax revenues with a gradual pick-up in economic activity, and huge subsidy burden & cash bleeding by loss-making Public-Sector Entities (PSE). For FY21, fiscal deficit is estimated to remain elevated at 8% of GDP after clocking-in at 8.1% in FY20.

Stock Market: Rising noise in the domestic politics and fear of spread of Coronavirus have caused lackluster stock market performance during the last few weeks. However, during FYTD through March 31st, the market has delivered robust returns of 30% and it has surged by a hefty 64% from its bottom hit during the Coronavirus crash in March 2020. We reiterate our sanguine view on the market over medium to long-term given improving economic outlook, supportive financial conditions, attractive market valuations, and promising corporate earnings prospects.

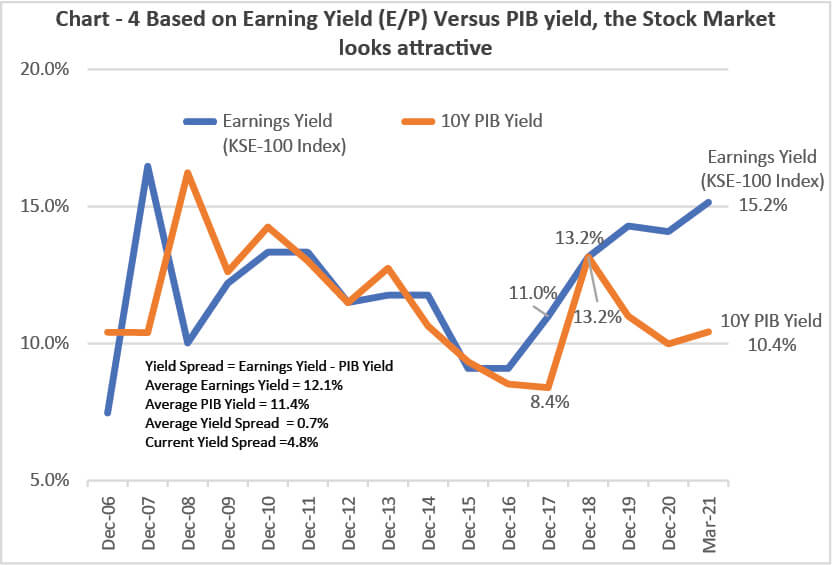

From the valuation standpoint, the market is trading at an attractive forward Price-to-Earnings (P/E) multiple of 6.6x, versus 10-year average of 8.4x. The Earnings Yield of 15.2% offered by the market also looks appealing compared with 10-year PIB Yield of 10.4% (see Chart-4). The stock market also offers a healthy dividend yield of 5%. We believe that downside risks to the economy emanating from the expected new taxation measures in the upcoming federal budget and likely hike in utility tariffs with its implication for the corporate profitability are largely priced-in stock market valuations. The recent pick-up in economic activity coupled with the easier financial conditions bode well for the corporate profitability, and we expect double-digit per annum growth in corporate earnings over the next two to three years.

The Bottom Line: The stock market holds potential to deliver strong returns in CY21, and beyond driven by: (i) attractive valuations as captured by the forward P/E multiple of 6.6x; (ii) double digit per annum growth in corporate earnings expected over the next two to three years; (iii) easier monetary conditions; and (iv) paltry yields on alternative fixed income avenues. Therefore, we advise investors with medium to long-term investment horizon to build positions in equities through our NBP stock funds.

Disclaimer: This publication is for informational purpose only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell the fund. All investments in mutual funds and pension funds are subject to market risks. The price of units may go up as well as down. Past Performance is not necessarily indicative of future results. NBP Funds or any of its sales representative cannot guarantee preservation / protection of capital and / or expected returns / profit on investments.