Historical market data cannot predict the future but it still serves as a useful guide to understand the potential risks and rewards for investors. With that in mind, we examine past performance of key domestic asset classes for over 10-year period from January 2011 to June 2021. We have included the most popular asset classes for which long-term data is available: Bank Deposits, National Savings Schemes (NSS), Gold, USD, Karachi Real Estate, Lahore Real Estate, and Stocks. For performance comparison, we have used the index provided by Zameen.com for the real estate sector. Inflation, as measured by CPI, has averaged 6.9% per annum and Pak Rupee has depreciated against the US Dollar by 6.0% per year, over the last ten years.

The objective of every long-term investor is the growth in his or her wealth, net of inflation. Worldwide, stocks have out-performed all other asset classes over the long-term. Political or economic pains may cause downturns periodically, but the resilience and recovery in the macro-economic factors enable stocks to maintain their long-term rising trend. Thus, short-term volatility spikes in the stock market should not worry long-term investors. Looking at the long-term performance of the stock market, it is evident that such periods with depressed returns do not stay forever. In the long run, stocks have outperformed all other asset classes, although it is volatile in the short-term.

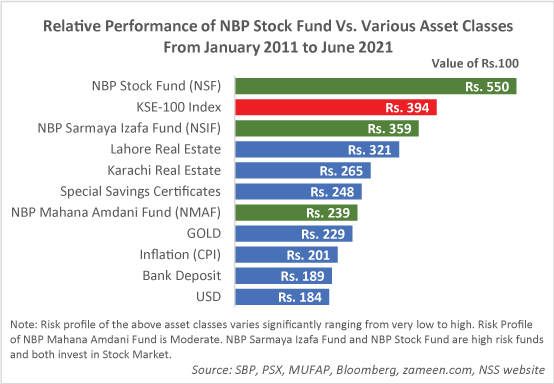

The historical analysis, as given in the Chart depicts that stocks offered the highest return amongst all asset classes. An investment of PKR 100 in the stock market (KSE-100 Index) in January 2011 would be worth PKR 394 by the end of June 2021. An investment of PKR 100 in Lahore Real Estate and Karachi Real Estate would be worth PKR 321 and RKR 265 respectively by the end of June 2021. During the same period, PKR 100 investment in bank deposits would have increased to a paltry PKR 189.

The outcome of the above analysis supports the basic notion that there is a positive relationship between risk and return, meaning higher the risk, the higher the return. In line with the expectation, stocks exhibited the highest volatility, and bank deposits have the lowest risk. The analysis also shows that over a long investment horizon, stocks delivered the highest return.

One take away from this analysis is that investors with long-term goals like educating their children, owning a house, or saving for retirement should have some of their assets invested in stocks, preferably through stock mutual funds, while investors with low-risk appetite due to short term investment needs, should invest in bank deposit or as an alternative in money market / income funds.

Well managed stock mutual funds have provided better returns to their investors than the stock market and other asset classes including real estate over the last ten (10) years period. As a case in point, our flagship stock fund, NBP Stock Fund (NSF) has out-performed the stock market by 156% over the last 10 years (from January 2011 till June 2021) by providing a return of 450% to our investors versus 294% rise in the stock market. An investment of Rs. 100 in NBP Stock Fund 10 years ago would have grown to Rs. 550 today, whereas an investment of Rs. 100 in the stock market (KSE-100 Index) 10 years ago would be worth Rs. 394 today. This out-performance of the Fund is net of management fee and all other expenses.

It is pertinent to mention that risk profile of the above asset classes varies significantly ranging from very low to high. Risk profile of bank deposit is low and risk profile of NBP Mahana Amdani Fund is moderate. Stock Market (KSE 100 Index), NBP Sarmaya Izafa Fund and NBP Stock Fund are high risk avenues.

What lies ahead for the stock market? We hold positive view on the stock market for FY22, and beyond given: attractive stock market fundamentals; strong momentum in economic activity; easier financial conditions; and promising corporate earnings outlook. The lackluster stock market performance during the last few weeks is attributable to the security situation in Afghanistan and sharp increase in positivity rate of Covid-19 in the country, and associated lockdowns. In our view, given attractive market fundamentals, these are buying levels as we don’t see any significant impact on the economic activity due to increased business restrictions and partial business shut down.

From the valuation standpoint, the stock market is trading at an attractive forward Price-to-Earnings (P/E) multiple of 6.5x, versus 10-year average of 8.4x. In addition to this, the stock market also offers a healthy dividend yield of 5.4%. On a relative basis, Earnings Yield of 15.4% offered by the market looks appealing compared with 10-year PIB yield of 9.94%. Helped by robust demand and strong profit margins, we expect corporate earnings to grow at double-digit rate over the next two to three years. In its monetary policy review on July 27th 2021, the SBP maintained the Policy Rate at 7%, cited accommodative monetary policy stance in the near term, and measured and gradual adjustments in the Policy Rate over time.

We advise investors with a long term horizon to invest in out Stock Funds, which have a track record of outperforming the stock market by a healthy margin.

Disclaimer: This publication is for informational purpose only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell the fund. All investments in mutual funds and pension funds are subject to market risks. The price of units may go up as well as down. Past Performance is not necessarily indicative of future results. NBP Funds or any of its sales representative cannot guarantee preservation / protection of capital and / or expected returns / profit on investments.