The last five years have been challenging for the stock market investors. This subdued performance of the stock market has come after eight consecutive years of robust returns during which the KSE-100 Index surged by around 747%. Looking at the long-term performance of the stock market, it is evident that such periods with depressed returns do not stay forever. In the long run, stocks have outperformed all other asset classes, although it is volatile in the short-term. Historical market data cannot predict the future but it is still a useful guide to understand the potential risks and rewards for investors. With that in mind, we examine past performance of key domestic asset classes for a 21-year period from March 2001 to February 2022. We have included seven asset categories for which long-term data is available: Treasury Bills, Bank Deposits, National Savings Schemes (NSS), Pakistan Investment Bonds (PIBs), Stocks, US Dollar and Gold. Inflation, as measured by CPI, has averaged 8.7% per annum and Pak Rupee has depreciated against the US Dollar by 5.3% per year, over the last twenty one years.

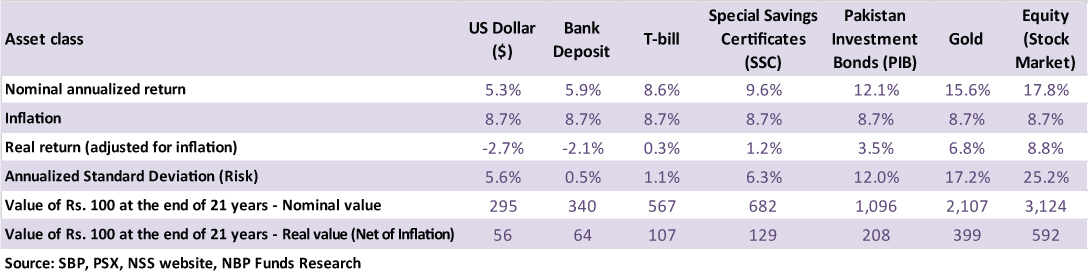

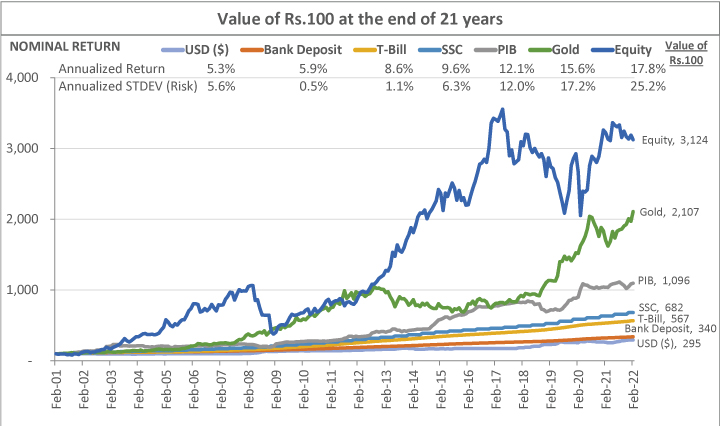

The historical analysis, as given in the Table below depicts that stocks offered the highest nominal and real return amongst all asset classes. An investment of PKR 100 in stocks in March 2001 would be worth PKR 3,124 by the end of February 2022. During the same period, PKR 100 investment in bank deposits and T-Bills would have increased to a paltry PKR 340 and PKR 567, respectively.

The outcome of the above analysis supports the basic notion that there is a positive relationship between risk and return, meaning higher the risk the higher the return. In line with the expectation, stocks exhibited the highest volatility, and bank deposits and T-Bills have the lowest risk. The analysis also shows that over a long investment horizon, stocks delivered the highest return.

One take away from this analysis is that investors with long-term goals like educating their children, owning a house, or saving for retirement should have some of their assets invested in stocks, preferably through stock mutual funds, while investors with low-risk appetite due to short term investment needs, should invest in bank deposit or in money market / income funds.

On equity market outlook, we continue to look favourably towards the market in terms of return, whereby we expect the market to provide around 20% per annum return in the coming years. However, market will continue to look keenly on developments on Russia-Ukraine conflict, and its implications on global commodities. Unless commodities spiral out of control, we expect the SBP to maintain the prevailing accommodative monetary policy stance with measured hikes in the upcoming monetary policies. From the fundamental perspective, the stock market is trading at an attractive Price-to-Earnings (P/E) multiple of 5.0x versus the long-term average of 8.4x. On relative valuation, 20% Earnings Yield offered by the stock market looks appealing compared with 11.07% yield on 10-years PIBs. For CY21, the y/y growth in earnings as per our estimates is projected at a whopping 43%. These are the most attractive valuations the stock market has seen since the 2008 financial crisis. Therefore, we advise investors with medium to long-term investment horizon to build positions in stocks through our NBP stock funds, which have a superior performance track record.

Disclaimer: This publication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any fund. All investments in mutual funds are subject to market risks. The price of units may go up as well as down. Past performance is not necessarily indicative of future results. Please read the Offering Documents to understand the investment policies and the risks involved. NBP Funds or any of its sales representative cannot guarantee preservation / protection of capital and / or expected returns / profit on investments. The use of the name and logo of National Bank of Pakistan does not mean that it is responsible for the liabilities/ obligations of the Company (NBP Fund Management Limited) or any investment scheme managed by it.