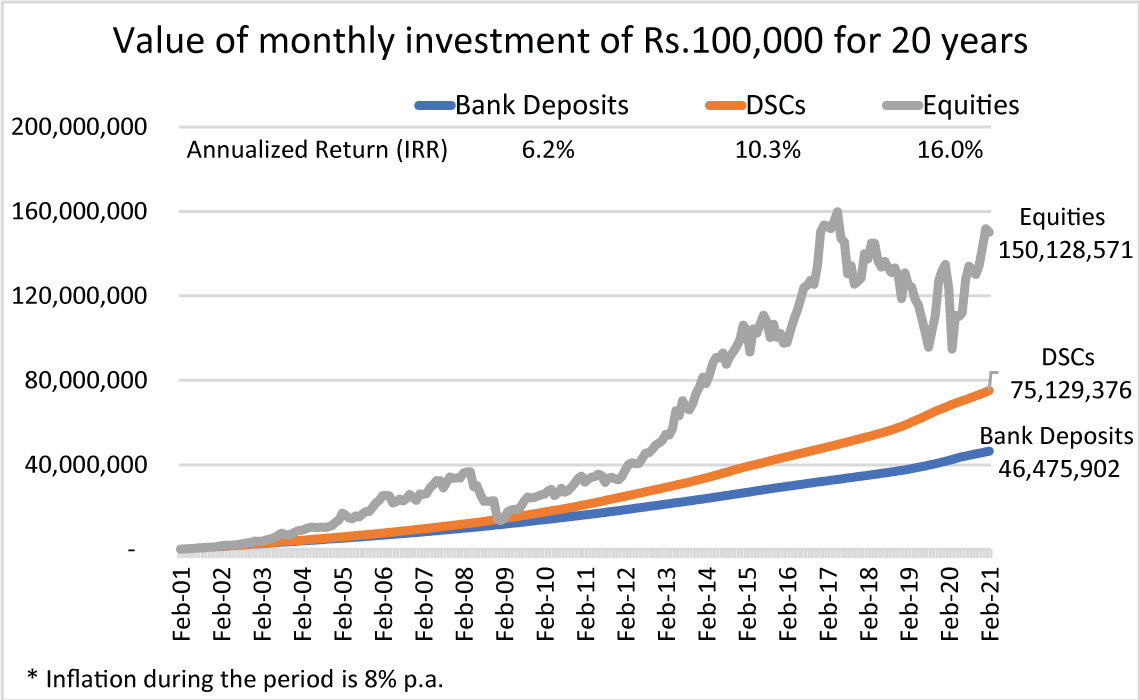

Despite lackluster performance in the last four years, the Pakistan stock market (KSE-100 Index) has delivered a robust return during the last 20 years. However, this performance has been accompanied by several ups and downs. In the long run, equity has outperformed other asset classes, although it is volatile in the short-term. If someone had invested Rs. 100,000 per month in the stock market over the last 20 years, his/her total investment of Rs. 24 million (100,000 x 12 x 20) would be worth about Rs. 150 million (Rs. 15 crores) today (see Chart below). The same Rs.100,000 per month invested in Defence Savings Certificates (DSC) over the last 20 years would be worth Rs.75 million today, while the same amount in bank deposits would be worth Rs. 46 million today.

Timing the stock market is always very difficult if not impossible. It is difficult when stocks are falling because losing money is painful and it always feels like stocks can fall further. And it is difficult when stocks are rising because you have to balance the Fear of Missing Out (FOMO) that comes from watching others get richer and the worry that any day the market may reach its peak and start declining.

To cope with the difficulty of timing the market environment, simple strategy is to keep buying no matter the stock market is rising or falling. Investing periodically over time completely takes the idea of market timing and the inherent stress that comes with it off the table. Do not try to outsmart the market. Plan on being a monthly investor in the stock market based on your monthly savings. Be perfectly comfortable with the fact that sometimes you will be investing in the market when it has appreciated substantially and sometimes you will be buying equities when they have fallen considerably.

Modest amounts of regular investments result in large sums of amounts overtime due to the power of compounding. Investors need to develop regular savings habit and then stick to it. The best way to save and invest is to write a check to a mutual fund of one’s liking at the beginning of a month. If one waits till the end of the month, there would generally be not enough funds left to invest. In other words, one has to be disciplined & force oneself to save and invest.

Generally, we hear investors saying that I missed a great opportunity to invest in the stock market, and now it is too late to invest as the market has already risen substantially. Timing the stock market is an almost impossible task, and even stock market “Gurus” fail at that. Therefore, the best approach is to save and invest in stock market fund(s) on a monthly basis, irrespective of whether the stock market is rising or falling. This globally popular investment strategy is commonly known as rupee cost averaging. This way an investor averages out his/her investment cost, and is successful in reducing the volatility or risk of stock market investing. The beauty of dollar cost averaging is that you diversify across time and market environments so you don’t need to worry about the timing of your purchases as much. The investment guru, Benjamin Graham, first popularized dollar cost averaging in his seminal 1949 book ‘The Intelligent Investor’. He writes: “dollar-cost averaging,” which means simply that the practitioner invests in common stocks the same number of dollars each month or each quarter. In this way he buys more shares when the market is low than when it is high, and he is likely to end up with a satisfactory overall price for all his holdings.”

Trustee of the provident / pension funds should also follow the strategy of building their stock market portfolios gradually via monthly investing in stock market funds. A large one-time investment of a provident / pension fund in a stock fund may not go very well with the employees of the company, if the stock market drops substantially following such an investment. Trustees can reduce this risk by gradually investing in the stock market. Investing some portion of the portfolio in equities is very important for provident / pension funds for capital growth and also as a hedge against inflation. Placing a disproportionate portion of employees’ funds in money market / fixed income avenues could prevent employees from reaching their financial goals as returns generated from these asset classes may not even keep pace with the inflation. Similarly, individual investors with long-term goals like educating their children, owing a house, or saving for their retirement should have some of their assets invested in equities, preferably through equity mutual funds. Since its inception on January 19th 2007, our flagship, NBP Stock Fund (NSF) has delivered a cumulative return of 493% versus 331% rise in the stock market (KSE 100 Index). This out-performance of NSF is net of management fee, and all other expenses.

Disclaimer: This publication is for informational purpose only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell the fund. All investments in mutual funds and pension funds are subject to market risks. The price of units may go up as well as down. Past Performance is not necessarily indicative of future results. NBP Funds or any of its sales representative cannot guarantee preservation / protection of capital and / or expected returns / profit on investments.