2020 has been a challenging and extremely volatile year worldwide owing to the dreadful Coronavirus pandemic that has taken over 1.8 million lives and placed millions of livelihoods at risk. Strict lockdowns catalyzed the most severe global economic contraction since the economic depression. The IMF projects the global economy to contract by 4.4% in 2020 before recovering by 5.2% in 2021. After experiencing growth in each of the last 68 years, Pakistan’s economy also recorded its first annual contraction in FY20. For 2021, our outlook for the global and domestic economy hinges on health outcomes. In our base case scenario, we assume that despite the emergence of new strain of the Coronavirus, the start of vaccination in the developed countries has increased expectation of end of the Coronavirus pandemic, and earlier than expected acceleration in the global economic activity.

Economic Growth: Pakistan’s economy was already under the influence of stabilization policies that entailed fiscal consolidation, monetary tightening, and market-based exchange rate regime. The shutdown of the business activity in the 4QFY20 led to GDP contraction of 0.4% in FY20. The economic activity has picked up pace in the recent months, post re-opening of the economy from the lockdown, as evidenced by the high frequency economic data, such as sale of retail fuels, cement dispatches, and motor cycle sales. Large Scale Manufacturing (LSM) data also corroborates pick-up in industrial activity as the overall output of Large-Scale Manufacturing Industries (LSMI) increased by 5.46% during July-October 2020-21 over July-October 2019-20. The SBP-IBA survey shows that the overall business confidence level has improved further in October 2020 to two years’ high of 55, with improvement in the perception of both the industry and services sectors. We anticipate the economy to grow by 2% in FY21 before improving to 3.4% in FY2022 due to gradual unleashing of the pent-up demand in some sectors of the economy, uptick in investment activity, and recovery in the agriculture and services sectors.

Inflation & Interest Rate: Despite subdued aggregate demand, inflation as measured by the CPI remained elevated at 8.6% during 2HCY20 primarily due to uptick in prices of select food items, which was attributable to supply shocks and locust attacks. We project inflation to remain elevated at 7.8% during CY21 due to upward revision in power tariffs & gas prices, new taxation measures in the upcoming federal budget on the demand of the IMF, and pass-through of expected increase in global crude oil prices. In our base case scenario, we expect the reversal of the monetary easing from the 2nd quarter of CY21 with a modest 1%-1.5% hike in the Policy Rate during CY21.

External Account: The external account continued the improving trend as the current account surplus of USD 1.64 billion was recorded during July-November 2020 vis-à-vis a Current Account Deficit (CAD) of USD 1.75 billion during the same period last year. We expect a CAD of USD 5 billion (1.8% of the GDP) during CY21 due to pick-up in economic growth. Foreign exchange reserves of SBP improved from USD 11.3 billion at CY19 end to around USD 13.2 billion at the end of CY20 on account of record workers’ remittances, US$ 1.4 billion inflows from the IMF’s Rapid Financing Facility (RFF), and temporary debt relief from the G-20 countries.

Foreign Exchange Market: Following the introduction of market-based exchange rate regime in May 2019, the exchange rate largely followed market fundamentals. During CY20, PKR depreciated by 3.2% against the USD after suffering a significant 11.5% devaluation in CY19 and 25.7% in CY18. Resultantly, PKR is now slightly below its equilibrium value as measured by Real Effective Exchange Rate (REER) with latest reading of 97.1. Going forward, considering that the PKR is now near its equilibrium value as measured by REER, and manageable external account position, we expect a measured 5-7% devaluation against the US Dollar during CY21.

Bond Market: During CY20, sovereign yields responded to a cumulative 6.25% reduction in the Policy Rate by the SBP. Yields on T-Bills largely tracked the change in the Policy Rate, while decline in PIB yields reflected market expectation of bottoming of the interest rates and eventual reversal of the monetary easing cycle. As we expect around 100-150 bps hike in the Policy Rate during CY21, we recommend investing in floating rate securities and short maturities in the fixed income portfolio.

Stock Market: In the depths of the Coronavirus-induced stock market crash in March, the benchmark KSE 100 Index had fallen by 37% from the year-high level of 43,219 in about 10 weeks. At that point, the CYTD return of the market was -33%. However, unprecedented monetary and fiscal policy response, gradual lifting of the lockdown, and earlier than expected arrival of the effective vaccines caused one of the biggest reversals in the history of the market, surging by 61% from its low level in March 25th till December 31th. Overall, the stock market managed to finish CY20 with a gain of 7.4%.

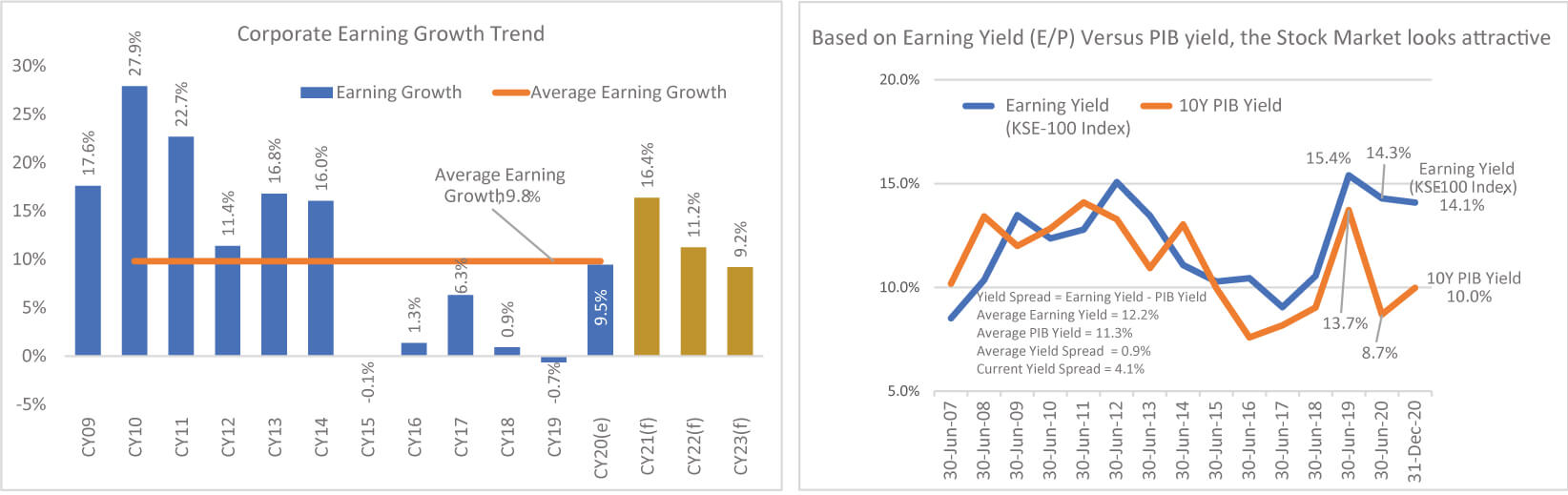

What do we expect from the stock market in CY21? From the valuation perspective, despite robust rally, the stock market is trading at an attractive forward Price-to-Earnings (P/E) multiple of 7.1x, versus 10-year average of 8.5x, showing a discount of 16.5%. On a relative basis, the Earnings Yield of 14.1% offered by the market looks appealing compared with 10-year PIB yield of 10%. The market is valued at a P/B of 1x compared to the long-term average of 1.7x. The market also offers a healthy dividend yield of 5.1%. Corporate earnings, the dominant driver of the stock market performance, are expected to grow at a double-digit rate over the next two to three years. The historical analysis shows that the stock market has depicted strong performance during the period of low interest rates and manageable current account deficit.

Key risks to our constructive view on the market stem from a severe second phase of Covid-19; failure to resume the IMF program and / or IMF’s tough conditions related to revenue targets & power and gas tariffs hike; and spike in global crude oil prices exerting pressure on balance of trade and feeding inflationary pressure.

Bottom Line: We see the current market levels a good entry point for investors with medium to long-term investment horizon. Our conviction for the positive market outlook for CY21, and beyond stems from: (i) attractive market valuation as captured in the attractive forward Price-to-Earnings multiple of 7.1x; (ii) robust corporate earnings growth for the next 2-3 years; (iii) a strong case for flow of funds toward equities, considering paltry yields on the alternate fixed income avenues; and (iv) easier financial conditions. Therefore, we advise investors to build positions in the market via our NBP Stock Fund, which have a superior long-term performance versus the benchmark and peer funds.