The IMF Executive Board met on Monday (29th August, 2022) and in line with the expectations, completed the combined seventh and eighth reviews under the Extended Fund Facility (EFF), allowing Pakistan to draw the equivalent of SDR 894 million (about USD 1.16 billion).

The EFF initial size was about USD6.0 billion at the time of approval. In order to support program implementation and meet the higher financing needs in FY23, the IMF Board has approved an extension to about USD6.5 billion. Not only will this provide support to the dwindling foreign exchange reserves, it will also ameliorate the credibility of Pakistan in the eyes of global financial community thereby paving the way for fetching further inflows from multilateral agencies such as the World Bank, Asian Development Bank, Islamic Development Bank and international capital markets. These inflows will alleviate concerns on the Balance of Payment position, stabilize PKR, and boost investors’ confidence.

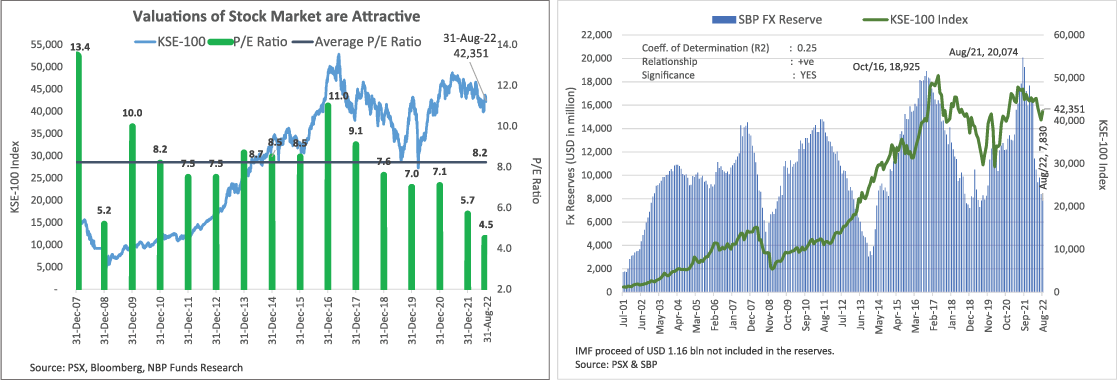

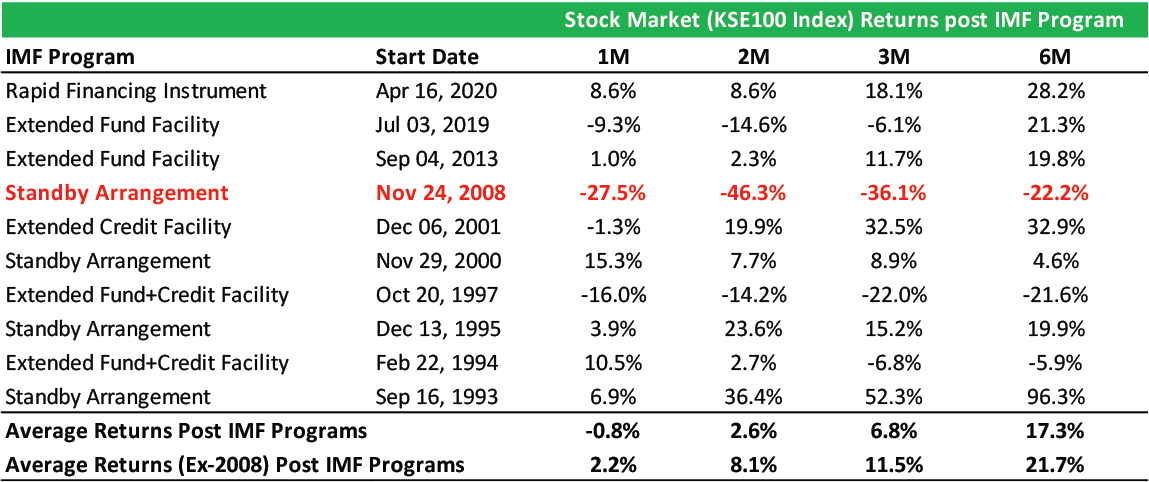

As the table below indicates, Pakistan equities generally respond favorably to the fiscal discipline and stability in external indicators that come with the IMF programs. On an average, PSX has yielded positive returns post the start of an IMF program. However, the Global Financial Crisis in 2008 was an exception.

IMF projections likely to be missed due to catastrophic floods: Pakistan has been devastated by the catastrophic floods caused by the unprecedented rainfall (395mm, 3x national average) during this monsoon, with satellite imagery showing much of Sindh and Baluchistan inundated. This will result in contraction in agricultural GDP and its second-round impact on manufacturing and services, significantly higher food inflation, and higher food and cotton import bill.

The economic projections released by IMF are very similar to the GoP estimates, but do not incorporate the impact of recent floods. As per NBP Funds estimates, both inflation and fiscal deficit will exceed IMF estimates, whereas GDP growth will be lower. The table below summarizes key economic projections of the IMF for FY23.

It is pertinent to mention here that easing of global commodity prices along with material inflows pertaining to flood related relief will tilt the needle in Pakistan’s favor. However, to put the economy on a self-sustaining growth path and regain macroeconomic stability, long-standing structural reforms need to be carried out immediately such as changing the economic growth model towards export-oriented sectors, expanding the tax base, rationalizing subsidies on utilities, eliminating losses of public sector enterprises, improving public sector governance, and spending more on education, healthcare, clean drinking water, etc.

Stock Market: Dismal performance of the market over the last six years and challenging economic situation have shaken the investors’ confidence as manifested by a large 61% contraction in the Price -to-Earnings multiple from 11.4x at the market peak in May 2017 to the prevailing level of 4.5x. Resumption of IMF program along with attractive valuations is expected to lead to a healthy market rebound. The IMF projects improvement in current account and a resultant increase in FX reserves, aided by inflows from friendly countries, which should bode well for the market. Historically, improvement in FX reserves has led to improved market sentiments and hence better stock market returns. From fundamental perspective, the market is trading at an attractive Price-to-Earnings (P/E) multiple of 4.5x, versus historical average of 8.2x. The market also offers a healthy 7-8% dividend yield. The recently announced corporate results have also shown strong double-digit growth, despite imposition of 10% super-tax.

Investors with medium to long-term investment horizon are advised to invest in the stock market via our NBP Stock Funds to capture attractive valuations, whereas risk averse investors can benefit from the high interest rate environment via our NBP Savings Funds.