Economy: After Coronavirus-induced contraction in FY20, Pakistan’s economy staged a V-shaped recovery as reflected by an estimated 3.94% GDP growth for FY21. We expect continuation of this growth momentum and anticipate GDP growth of 4.3% in FY22. The rebound in economic activity is also corroborated by the frequently released economic data such as power consumption, cement dispatches, automobile sales volume, and sales of retail fuel. SBP-IBA Business Confidence Survey that gauges the perception of company managers about current and expected business conditions shows that the Current Business Confidence Index (CBCI) reached the highest level since its inception; increasing by 6 points to 64 in June 2021 over April 2021.

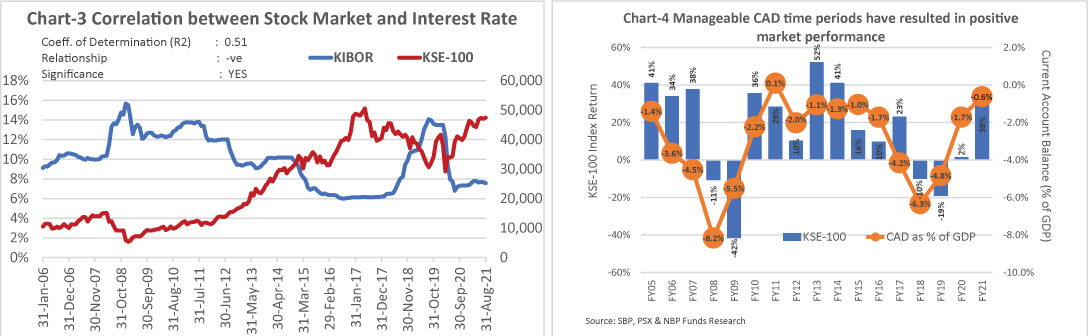

On Balance of payment (BoP) position, Current Account Deficit (CAD) clocked-in at USD 1.8 billion (0.6% of GDP) in FY21. Considering further pickup in economic growth and jump in commodity prices, we anticipate the CAD to widen to a still manageable level of USD 7.6 billion (2.3% of GDP) in FY22. With the receipt of USD 2.7 billion from the IMF on account of SDR allocation, the SBP’s FX reserves are likely to touch new highs. With regard to fiscal operation, FBR tax collection witnessed remarkable performance as revenues grew by 19.2% to Rs. 4,764 billion during FY2021 against the collection of Rs. 3,997 billion in the comparable period of last year. Similarly, according to revenue board, FBR collected Rs. 849 billion during July-August 2021 as against the target of Rs. 690 billion for the same period. On Covid-19 front, the strategy of smart & targeted lockdowns has worked well; and considering the vaccination progress, major eligible population is expected to get vaccinated in next couple of months, which would allow the economy to continue to operate uninterrupted.

Stock Market: Despite attractive market fundamentals, lacklustre stock market performance during the last few months is attributable to concerns on security situation in Afghanistan, fear of disruption to the economic activity amid elevated Covid-19 cases in the country, and emerging risks to the Balance of Payment position emanating from widening Current Account Deficit (CAD).

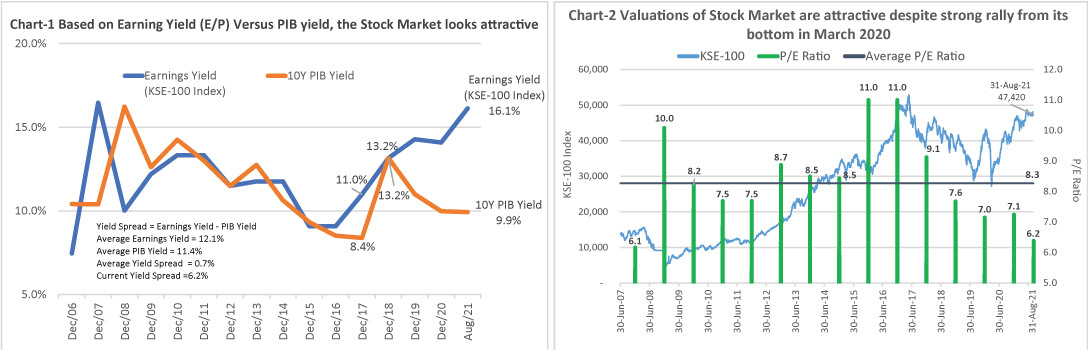

From the valuation perspective, despite sharp recovery from the coronavirus induced crash in March 2020, the stock market is trading at an extremely attractive forward Price-to-Earnings (P/E) multiple of 6.2x against the 15-year average of 8.3x. At the current levels, 16.1% Earnings Yield offered by the stock market along with a healthy 5.4% dividend yield makes it appealing compared with 9.9% yield on a 10-year PIB. Likewise, the market is trading at Price-to-Book Value (P/BV) of 1.0x versus the 10-year average of 1.75x.

After a sharp reduction in the Policy Rate from 13.25% to 7% between March to June 2020, the SBP has maintained status quo thereafter. Given elevated Covid-19 cases and still considerable slack in the economy, the SBP is expected to continue with the accommodative monetary policy regime with a gradual and measured hike in the Policy Rate, going forward. Though investors’ concerns on rising CAD are not unwarranted, the policymakers seem better prepared this time to navigate it. Instead of fixation on the fixed exchange rate, the SBP has let the currency depreciate by around 9% against the USD from its recent peak during the last couple of months to curb import-based demand. Current Account Deficit (CAD) narrowed to USD 1.8 billion (0.6% of the GDP) in FY21 from USD 19.2 billion (6.1% of the GDP) in FY18, that is anticipated to widen to USD 7.6 billion (2.3% of GDP) in FY22. Historical analysis shows that the stock market performs well in a declining inflation & interest rate environment (see Chart 3) and manageable Current Account Deficit (see Chart 4).

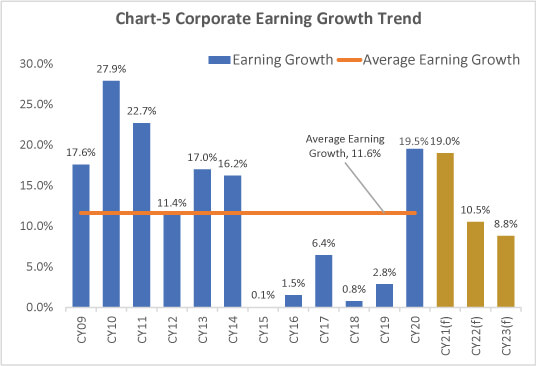

The combination of slowdown in economic activity, sharp currency devaluation, contractionary monetary policy, and some one-off company specific factors led to a muted corporate earnings growth from CY15 to CY19. However, given robust economic growth trend, strong pricing power, and lower borrowing cost; corporate earnings are expected to grow at double-digit rate over the next two to three years (see Chart 5).

On geopolitical front, the peaceful takeover of Afghanistan by Taliban following US troops’ withdrawal bodes well for security situation in Pakistan and the entire region. While there are some challenges, these developments also offer tremendous economic opportunities for the country that can be reaped by focusing on regional connectivity, and by building long-planned trade and energy routes from Pakistan to Central Asian states.

The Bottom Line: We see the current market levels a good entry point for long-term investors. We hold a positive view on the market for FY2022, and beyond given: (i) attractive stock market valuation as captured in the Price-to-Earnings multiple of 6.2x; (ii) robust corporate earnings growth expected for the next 2-3 years; (iii) paltry yields on the alternative fixed income avenues; (iv) abundant local liquidity sitting on the side line, awaiting to enter the market; and (v) easier financial condition as reflected by tighter credit spread and accommodative monetary policy. Therefore, we advise investors to build positions in the market via our NBP Stock Fund / NBP Islamic Stock Fund, while keeping their long-term investment objectives in mind.

Disclaimer: This publication is for informational purpose only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell the fund. All investments in mutual funds and pension funds are subject to market risks. The price of units may go up as well as down. Past Performance is not necessarily indicative of future results. NBP Funds or any of its sales representative cannot guarantee preservation / protection of capital and / or expected returns / profit on investments.