For the past couple of years, politics has captured much of Pakistan’s time and attention, with political and non-political stakeholders battling out for the hold of power and influence. Off late, however, the political temperature has certainly risen as differences between the ruling coalition and opposition over the timing of elections have taken center stage.

The result of all of this has been a shift of focus away from the economy which has led to delays in critical economic decisions at a time when the country is facing one of its worst economic crises. The debt burden and the structural fiscal and current account deficits have grown to unsustainable levels amidst record high global food and fuel prices as a result of Russia-Ukraine conflict. All of these factors, coupled with the devastating floods, have resulted in record inflation, plummeting PKR-USD parity, and drop in foreign reserves barely enough to cover one month’s imports. If Pakistan is to remain solvent, the IMF program must be continued. In order to restore the confidence of external partners including the IMF, multilateral institutions, and friendly countries, political situation needs to be sorted out, and focus must return back to the economy.

Amidst all this chaos, the ongoing dialogues between PDM and PTI provide a glimmer of hope. News flow and events also suggest that there is now an increasing chance of Staff Level Agreement with IMF being signed provided the remaining gross financing needs are arranged. Reportedly, the government is already in talks with friendly nations and their commercial banks to bridge the financing gap. IMF may also revisit its estimate for CAD of USD8-8.5bn for FY23 as opposed to USD3.4bn that has actually been registered during 9MFY23. The success of the ongoing PTI-PDM negotiations is likely to have a significant impact on the support that IMF and other friendly countries are willing to provide. Despite any apprehensions, mistrust, and conflicts among political factions, it is crucial that stakeholders reach a resolution promptly, for the benefit of the people and economy.

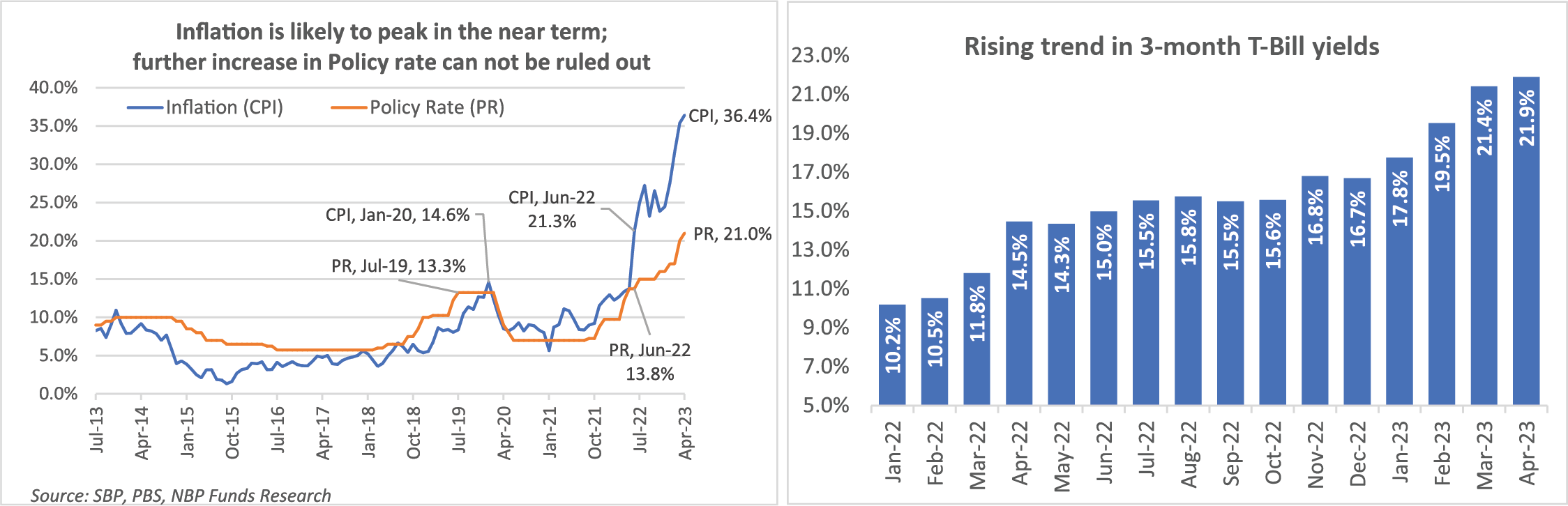

Fixed Income Investments: In order to contain the aggregate demand pressure and anchor inflationary expectations, the central bank has aggressively raised Policy Rates by a cumulative 725 bps in FY23 from 13.75% to the historical high of 21% in the ongoing monetary tightening cycle. The latest inflation as measured by CPI clocked in at 36.4% for Apr-23. Given the current level of the Policy Rate, real interest rate, and inflation trajectory, a further 100-200 basis points hike cannot be ruled out. Inflation and interest rates are expected to remain elevated during CY23, though barring any external shock, we expect an ease off in inflation due from June 2023 onwards due to the high base effect with interest rates likely to ease from 1HCY24. The sovereign yields have responded to the hike in Policy Rate by the SBP as yield on 3-month T-Bills has increased to 21.9% from 15.0% in June 2022. In line with the increase in interest rates returns offered by income avenues have become quite attractive. Improving returns along with the added benefits of ease of withdrawal and lower tax rates have made money market and income mutual funds an attractive option for investors in both the conventional and Islamic categories. They are currently offering high double-digit returns with recently launched plans offering returns in excess of 20%. These plans are ideal for investors with low risk appetite, short investment horizon, and higher liquidity requirements.

Corporate profits break all barriers in March 2023, stock market valuations at record lows! In this challenging macro environment, KSE100 index companies have shown exceptional resilience where they have registered highest ever cumulative quarterly profit of PKR 391bn (around 93 companies representing approx. 98% of KSE100 profits have announced results) with year-on-year growth of 19% in March 2023 and quarter-on-quarter growth of 40% over December 2022. This growth has come despite imposition of taxes and serious cost pressures, including steep hike in cost of capital.

In terms of stock market outlook, we acknowledge the heightened economic risks arising from deterioration on the external front due to elevated repayments on the financial account. These are visible from country’s USD bond yields & CDS spreads, which have reached unprecedented levels. Having said this, we opine that current stock market valuations adequately compensate for the risks highlighted. Any tangible improvement on economic & political front is expected to trigger a strong rally.

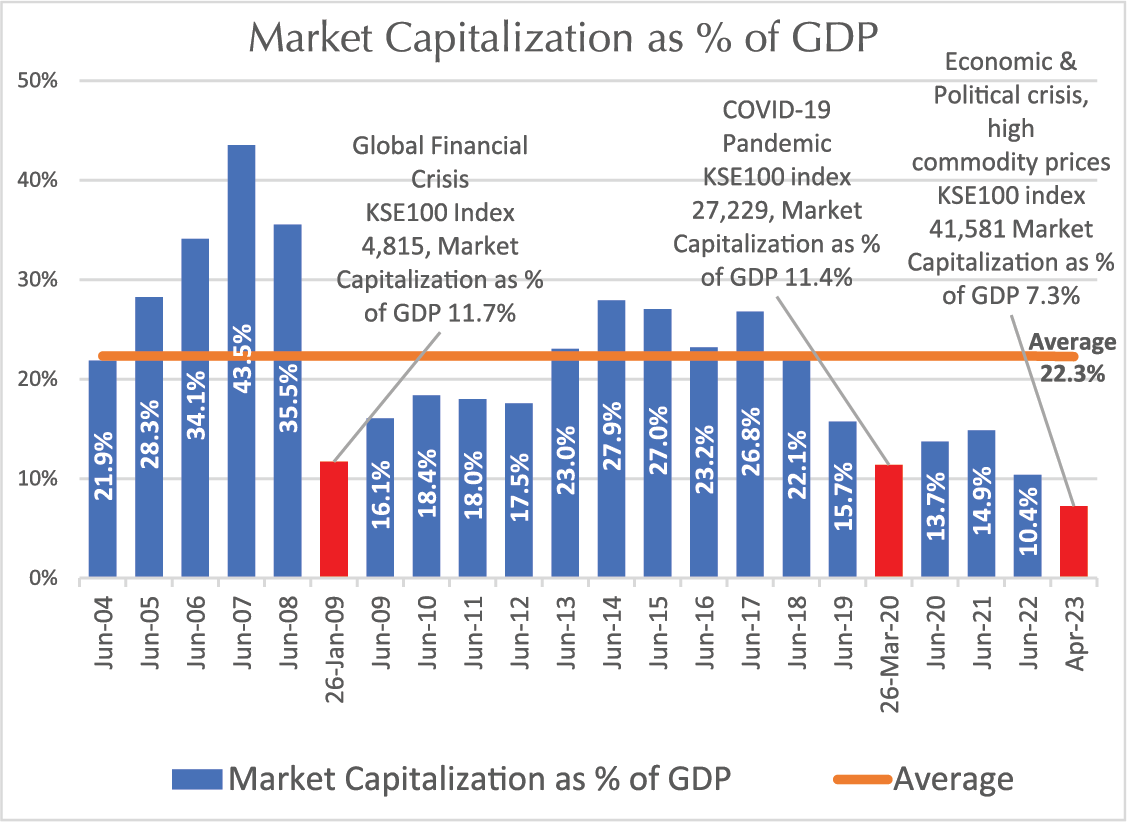

Looking at the fundamentals, the valuations of the stock market remain inexpensive. As a result, the mostly looked at valuation metric, forward Price-to-Earnings Ratio (P/E) has declined to multi-year low of around 3.8 times (Bloomberg estimate at 3.3x). The Market-Cap to GDP ratio, has also touched historic low levels, suggesting very small proportion of national disposable income is being channeled towards equity investments. Foreign selling, which was a key reason for market underperformance, has also slowed down significantly, as foreign holdings are now a very small proportion of the total free float.

Therefore, investors with medium to long-term investment horizon are advised to consider the prevailing market levels as a buying opportunity via our NBP Stock Funds. Investors with limited risk appetite and high liquidity requirements can benefit from our income and money market funds, which are expected to provide strong double digit returns in the prevailing high interest rate scenario.