The last five years have not been good for the stock market investors, and many are questioning their decision to have invested in the stock market. The lackluster performance of the stock market over the last five years is associated with the burgeoning current account deficit, depleting FX reserves, surge in inflation and interest rates on the back of rising commodity prices, and deceleration of GDP growth. These factors coupled with heightened local and geo-political uncertainty have ravaged equity investors’ returns and confidence. However, the listed constituents of the stock market are enjoying unprecedented profits and the March 2022 results indicate 2022 to be yet another stellar year in terms of bottom-line growth.

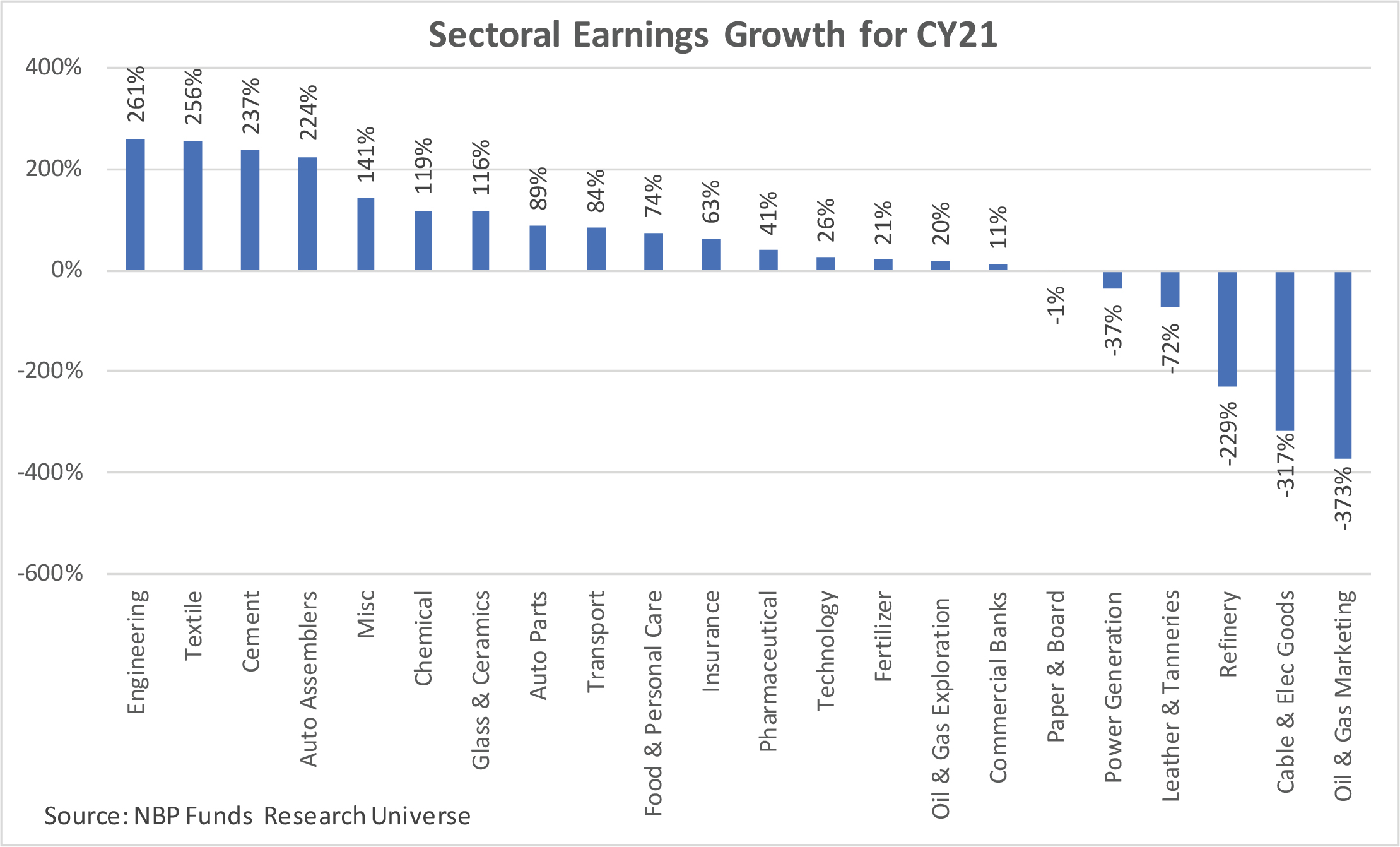

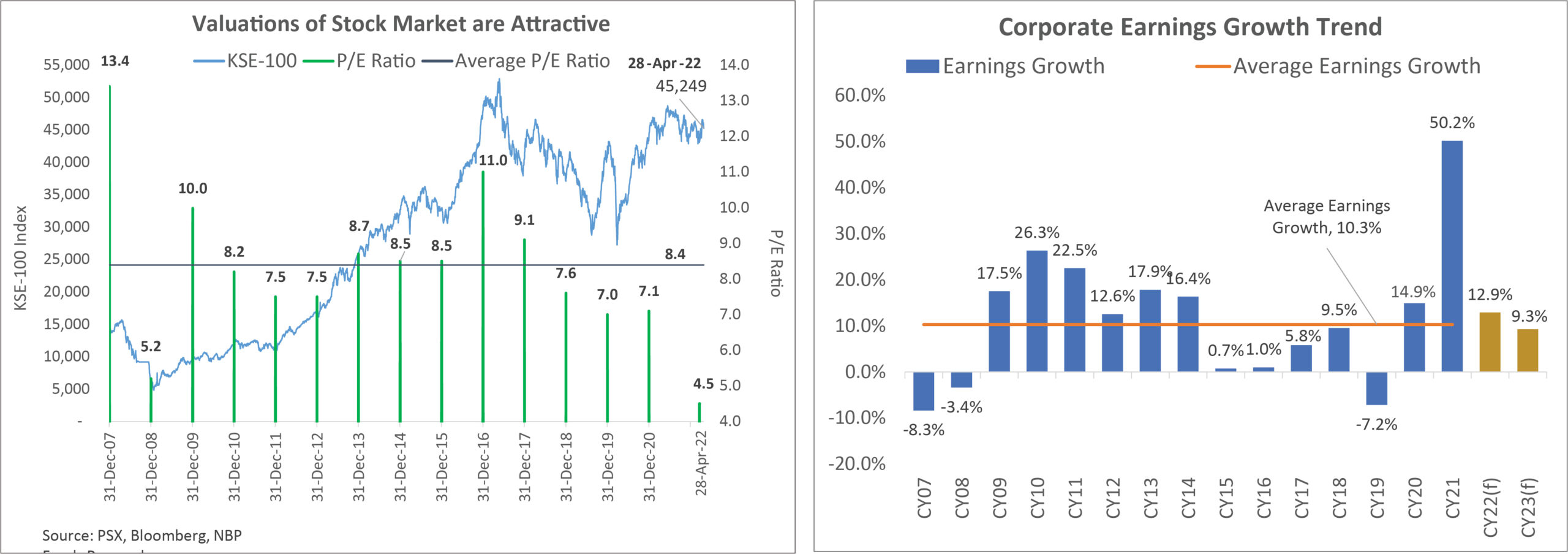

Corporate profits in 2021 massively beat expectations; 2022 can be a repeat! At the start of CY21, market consensus of corporate earnings growth stood at 16% whereas the actual growth came in at 48% for the KSE-100 companies, and 50% for NBP Funds’ universe. Thus the actual results overshot expectations by 3x! Since 2005 (where majority of the corporate sector got listed), the CY21 listed corporate profitability growth is highest ever and is almost 5x the average historical growth of 10.3%. This growth was primarily driven by Textiles and cyclical sectors such as Engineering, Cement, Autos etc., all of which recorded profit growth in excess of 200%.

The general consensus and indeed, the investor fears were that due to high base effect, the corporate sector will be unable to produce such exceptional performance going forward and the profitability growth for CY22 may fall to low single digit or may even be negative. However, March 2022 quarterly results have mostly been announced and despite the high base, the corporate profits have surged even higher, with growth of 33% Y/Y. While the macroeconomic variables indicate a slowdown in the economy ahead, the listed corporates at PSX are relatively shielded as 60% of them are direct or indirect beneficiary of rising oil prices, higher interest rates, and PKR devaluation. This year, we expect the traditional safe haven sectors such as Oil and Gas Exploration, Commercial Banks, and Fertilizers to keep the earnings momentum strong. Many of the cyclical sector stocks enjoy exceptionally strong asset base with cash rich – debt free balance sheets, which will shield them from major dent in earnings. To further highlight the extent to which corporate profits have surpassed expectations, if CY22 corporate profit growth continues at the same pace as it has in the first quarter, the corporate profitability this year will reach the levels which, the market was expecting to achieve in CY27.

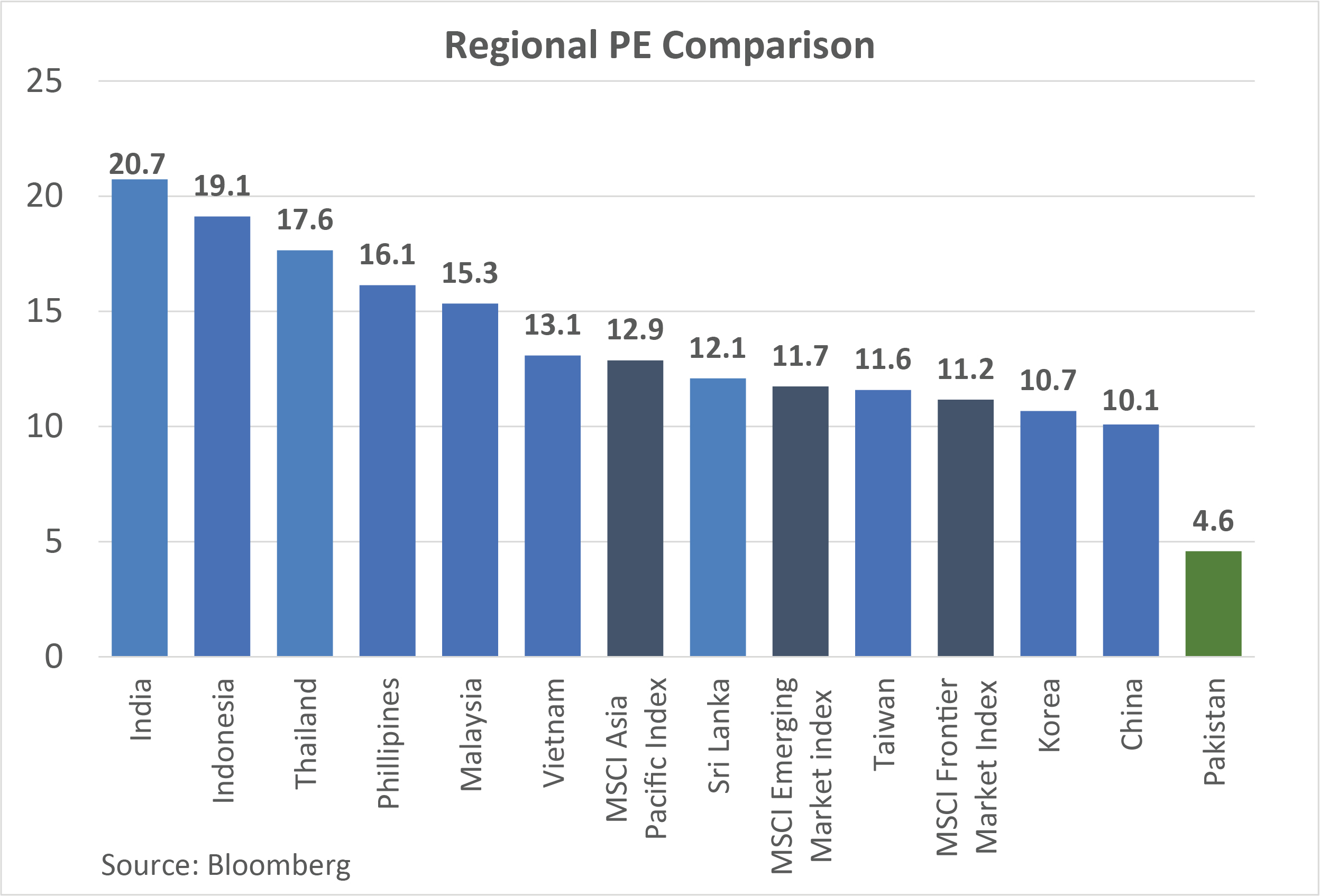

Valuations are near 2008 financial crisis levels: We believe that the prevailing pessimism provides a buying opportunity for investors with medium to long-term investment horizon. From stock market perspective, the quantum of foreign selling has also slowed post outflow of almost USD2.3bn during CY2016-2021. Market is expecting inflows in vicinity of USD 30-40 million once Pakistan formally becomes part of the Frontier Market Index this month. The slowdown in foreign selling should help market generate better returns in CY22. Despite record profits by the listed corporate sector, the performance of stock market since the start of CY22 has remained lackluster. As a result, the mostly looked at valuation metric, Price-to-Earnings Ratio (P/E) has come down to multi-year low of around 4.5 times. The last time market traded at this level was post Global Financial Crisis (GFC) time in Jan-09. Therefore, we continue to look favorably towards the market in terms of return, whereby we expect the market to provide around 20% upside in CY22.

In the chart above, we have also provided comparison of regional Price-to-Earnings (PE) ratio. It can be seen that PSX is by far the most attractive market in terms of PE Multiple, trading at 64% discount to the median PE of 12.9x for regional peers. With double digit growth in earnings and PE rerating on the cards, the market is well poised to deliver a healthy double-digit return in CY22 and beyond, despite mounting political and economic challenges. Therefore, investors with medium to long-term investment horizon are advised to consider the prevailing market levels as a buying opportunity via our NBP Stock Funds.