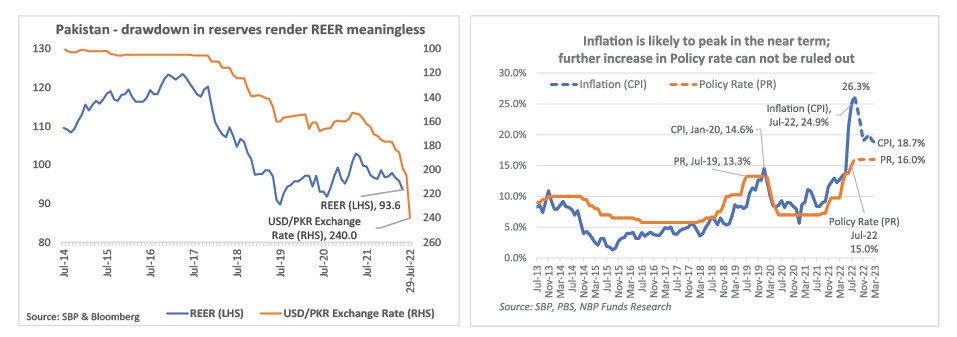

The month of July 2022 saw the Pakistani rupee depreciate by 17%, worst depreciation of the PKR in history since the adoption of market-based exchange rate regime in the 1980s. With that, PKR has devalued by around 36% from January this year till July end. Though IMF has accorded its nod & Staff Level Agreement has been reached, but the usual delay in Board approval before realization of inflows remains a cause of concern as reserves remain abysmally low and under pressure with a decline of USD 1,241 mn in the month of July to USD 8.6 bn, as of 22nd July. The stress on PKR due to high trade and current account deficits, has been exacerbated by the ongoing political uncertainty, and has led to an increase in inflation and interest rate expectations on account of imported inflation.

Inflation and Policy Rate outlook for FY23: For FY23, we now expect the average inflation to be in vicinity of 20%, in line with the SBP estimates. As mentioned earlier, while inflation will be high on account of PKR depreciation and the resultant imported inflation, it will also remain elevated due to expected upward adjustment in power & gas utility prices, further increase in retail fuel prices, and imposition of additional taxes. In order to contain the aggregate demand pressure and control the expected rise in inflation, in its recent monetary policy meeting, SBP has increased the Policy Rate by 125 basis points (cumulative 800 bps from 7% to 15.0%). Considering the inflation trajectory, further hike in interest rates is likely, though its quantum may be limited due to the cost push nature of inflation and slowdown in the economy. With global commodity super cycle waning gradually, we remain cautiously optimistic on the ability of the country to steer through the ongoing challenges, though any upward pressure on the same will force SBP to adopt a tightening stance for a longer period.

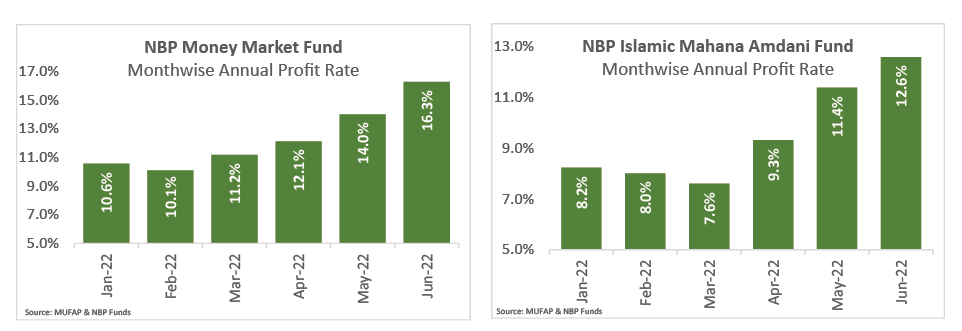

Investment outlook – Fixed Income: In line with the increase in policy rates, returns offered by the fixed income avenues have become quite attractive. Similarly, improving returns along with the added benefits of ease of withdrawal have made income mutual funds an attractive option for investors in both the conventional and Islamic categories, which are currently offering double-digit returns. These income funds are ideal for investors with low risk appetite and higher liquidity requirements.

As the above charts show, the return on our income funds has increased accordingly with the increase in the Policy Rate. NBP Money Market Fund that primarily invests in T-Bills and AA rated bank deposits has offered its investors an annualized return of 16.3% during June 2022. NBP Islamic Mahana Amdani Fund is a Shariah Compliant income scheme that aims to provide monthly income to investors by investing in Shariah Compliant money market and debt avenues. The Fund is ideal for investors looking for a regular stream of income to meet their monthly expenses. The monthly profit is transferred to the investor’s bank account at the end of each month. During June 2022, the Fund has provided its investors an annualized return of 12.6%.

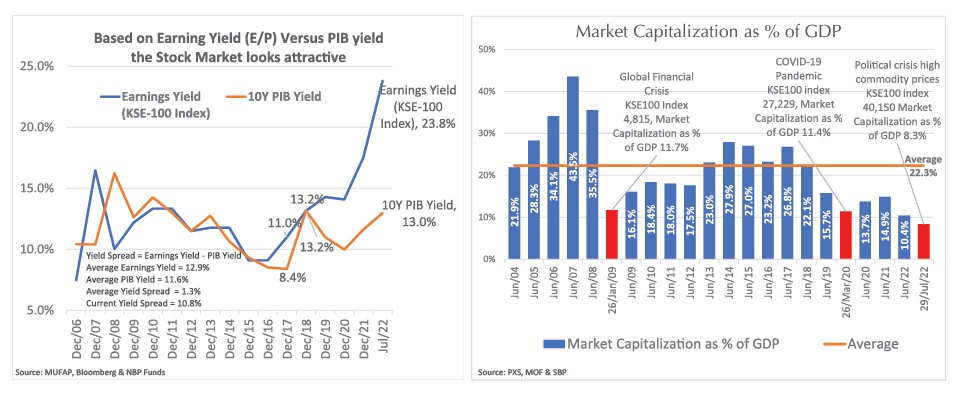

Investment outlook – Stock Market: In terms of stock market outlook, we feel that current stock market valuations compensate for the risks highlighted. Corporate profitability is expected to grow by around 15% in FY22, despite imposition of 10% super tax. For FY23, we expect the growth to moderate to 7-9%. Due to mounting inflationary pressures amidst steep devaluation seen in the last few months, demand as well as margins of cyclical corporates will come under pressure. However, for other sectors that remain insulated from demand pressures, and are beneficiaries of PKR devaluation and interest rate upcycle like Oil & Gas, Power Generation, Fertilizers, Technology, and Commercial Banks, we expect robust earnings growth going ahead, offsetting the decline in cyclical sector profitability. Therefore, we expect that overall corporate profitability would continue to grow, albeit at a modest pace. Due to lacklustre market performance over the last few years, Price-to-Earnings Ratio (P/E) has come down to a multi-year low of around 4.2 times (earnings yield of around 24% vs 10yr PIB yield of 13.0%). The Market Capitalization to GDP ratio has also touched historic low levels of 8.3% against the long-term average of 22.3%. Any tangible improvement on economic front is expected to trigger a strong rally, whereas the resumption of IMF program also remains a key trigger.

Investors with medium to long-term investment horizon are advised to invest in the stock market via our NBP Stock Funds to capture attractive valuations, whereas risk averse investors can benefit from high interest rate environment via our NBP Savings Funds.