In a landmark decision, the Supreme Court of Pakistan overturned the move to dissolve the assemblies, consequentially restoring the No-Confidence motion, which will now be held on April 09. The constitutional gap that had been created post the dissolution has now been bridged, which has been celebrated by the stock market. After the vote, it is expected that a new government will be in place and it will initially take measures to address economic and political challenges. However, early elections are likely to be announced which will result in formation of an interim setup. Though the new government will restart negotiations with IMF, we expect the interim setup to take the requisite harsh steps of raising petrol and utility prices along with tough taxation measures, with little to no political costs. Both the ruling party and the opposition will be entering election mode where they will have to get back to their constituencies and win their support.

We are of the opinion that regardless of who stays at the helm of affairs, it will be the implementation of the economic reform agenda under the IMF program that will dictate the course of our economy and that of capital markets. While the economic growth trajectory looks reasonable considering the strong recovery in demand, Pakistan is facing serious economic challenges of rising inflation and current account deficit. We have seen such challenges before during FY17 and FY18 and prior to that in FY08. The problem has been compounded by the unprecedented surge in global commodity prices that has significantly ballooned the import bill. The current account deficit (CAD) has risen sharply to USD 12 billion during 8MFY22, compared with a current account surplus of USD 1 billion during the same period last year. We expect the CAD to range around USD 18 billion during FY2022 which will put serious pressure on the foreign exchange reserves. During CY21, we saw FX reserves improve from USD 13.4 billion to USD 17.7 billion on the back of flows from multilateral agencies such as ADB & World Bank and Kingdom of Saudi Arabia. However, CY22 has seen sharp erosion in reserves to USD 12 billion, which translates to import cover of less than two months.

Economic Reforms are Key: Pakistan is undergoing its seventh review under the IMF’s Extended Fund Facility program, which has disbursed USD 3 billion out of the total USD 6 billion. However, the program has stalled due to ongoing political turmoil and IMF is now expected to negotiate the program only with the newly elected government. Considering the external account position highlighted before, we feel that continuation of the IMF program is imperative for the economy, investors, and businesses. Besides the financial relief, IMF program would ameliorate the credibility of Pakistan in the eyes of global financial community, paving the way for fetching flows from multilateral agencies such as the World Bank, Asian Development Bank, Islamic Development Bank, and also facilitate access to international capital markets.

Followed by the IMF program, the focus of the new government must shift to long needed structural reforms that include a) expanding the narrow tax base by taxing all sources of income including Agriculture & Real estate at same rate, b) Privatization of State Owned Enterprises, c) rationalization of current expenditures in favor of development expenditures, d) improving governance standards and competence at all government levels, e) fiscal consolidation by raising utilities tariff and reducing circular debt, and f) implementation of policies to promote exports and curtail imports especially non-essentials, under a flexible exchange rate regime.

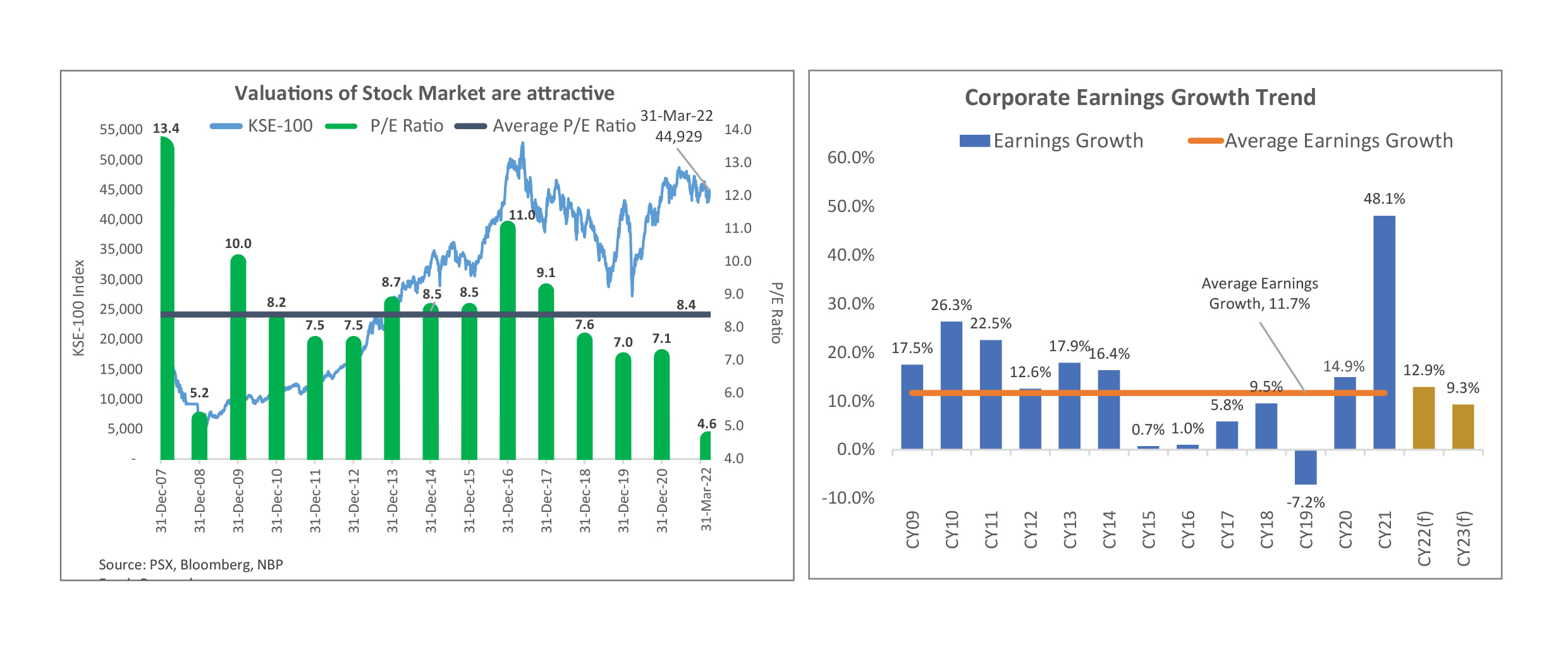

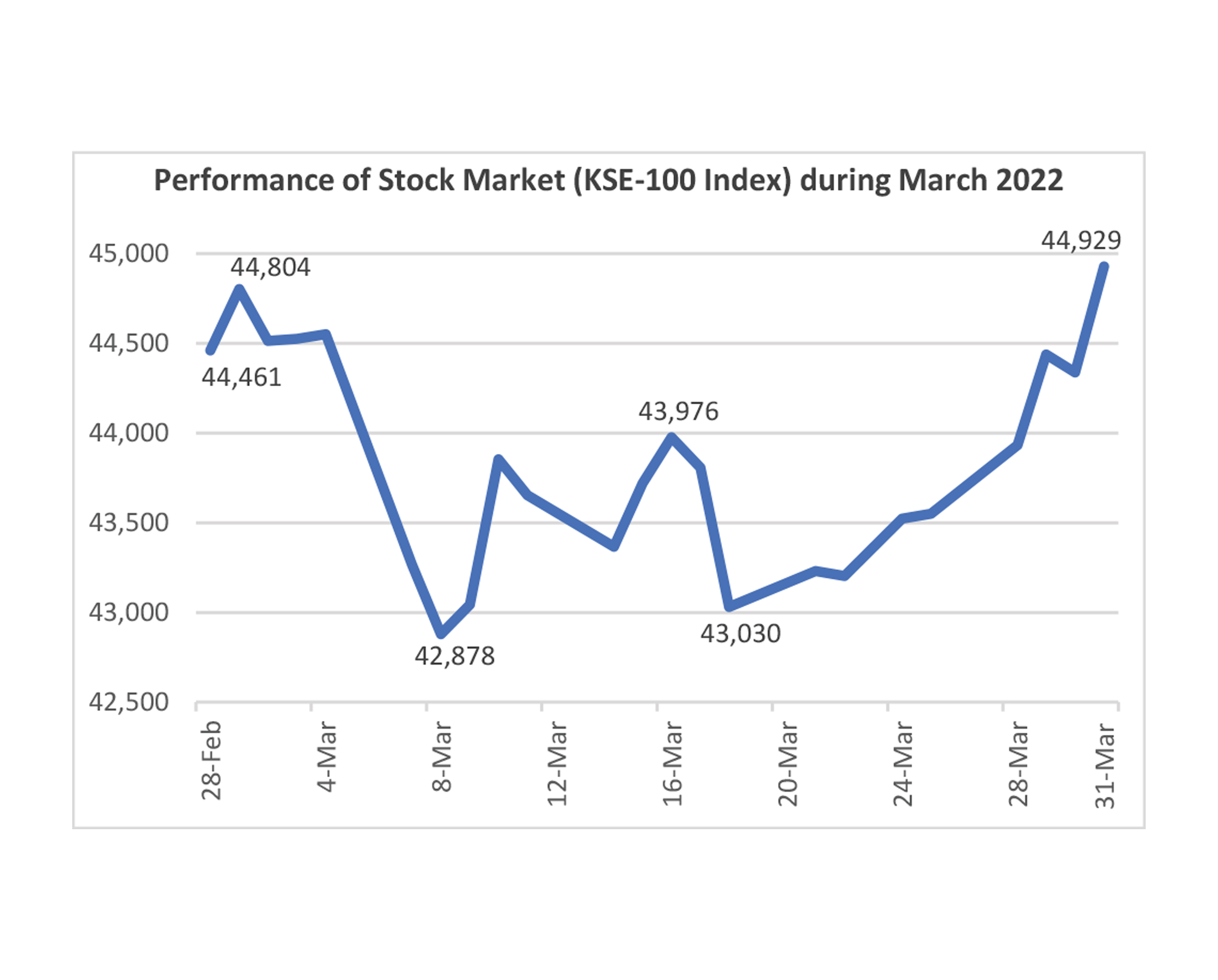

Stock market outlook: On the equity market outlook, though there are mounting political risks amid a) inflationary pressures stemming from unprecedented commodity prices and b) fiscal over-runs due to the recently announced relief package and, c) a stalled IMF program, we believe that the current stock market valuations more than compensate for these risks. Importantly, the quantum of foreign selling has also slowed post outflow of almost USD2.3bn from CY2016-2021. Market is expecting inflows in vicinity of USD40mn once Pakistan formally becomes part of the Frontier Market Index in May 2022. The slowdown in foreign selling should help market generate better returns in CY22. We are almost through the Dec-21 result season, where listed corporates have posted record set of profitability. Cumulative profits are estimated to have grown in excess of 48% on a yearly basis. On the other hand, performance of stock market since the start of CY22 has remained lackluster, at best. As a result, the mostly looked at valuation metric, Price-to-Earnings Ratio (P/E) has come down to multi-year low of around 4.6x. The last time market traded at this level was post GFC time in Jan-09. Therefore, we continue to look favorably towards the market in terms of return, whereby we expect the market to provide around 15-20% upside in CY22.

From fundamental perspective, market is trading at an attractive Price-to-Earnings (P/E) multiple of 4.6x, versus historical average of 8.4x. The market also offers healthy dividend yield in excess of 7%. Taken together, we advise investors with medium to long-term horizon to build position in the stock market through our NBP stock funds.

Disclaimer: This publication is for informational purposes only and nothing herein should be construed as a solicitation, recommendation or an offer to buy or sell any fund. All investments in mutual funds are subject to market risks. The price of units may go up as well as down. Past performance is not necessarily indicative of future results. Please read the Offering Documents to understand the investment policies and the risks involved. NBP Funds or any of its sales representative cannot guarantee preservation / protection of capital and / or expected returns / profit on investments. The use of the name and logo of National Bank of Pakistan does not mean that it is responsible for the liabilities/ obligations of the Company (NBP Fund Management Limited) or any investment scheme managed by it.