Economy: The Covid-19 pandemic has entered its second phase worldwide after reopening of economies and increased mobility, where case counts are again on an ascend. However, healthcare systems now have a better understanding of Coronavirus and a better supply of medical equipment such as personal protective equipment, ventilators and antiviral drugs. The global death rate peaked in April at about 7%, an alarming number that has declined ever since and is now approaching 2%. Therefore, rather than a full-scale lockdown that brings economic and social life to a standstill, the response has relied on strict but targeted rules for contact tracing, social distancing, and mask-wearing. In Pakistan, the number of new infections has also started rising however, we do not see another round of national lockdown and significant disruption to the economic activity. Encouragingly, there is good news on the vaccine development front. The Covid-19 vaccine developed by the Oxford-AstraZeneca has shown 70.4% efficacy. Earlier, the announcement came from the successful stage 3 trial of Coronavirus vaccines by Pfizer & BioNTech with 90% efficacy, and Moderna, with 94% efficacy. Russia has also claimed 92% effectiveness for its Sputnik V vaccine candidate.

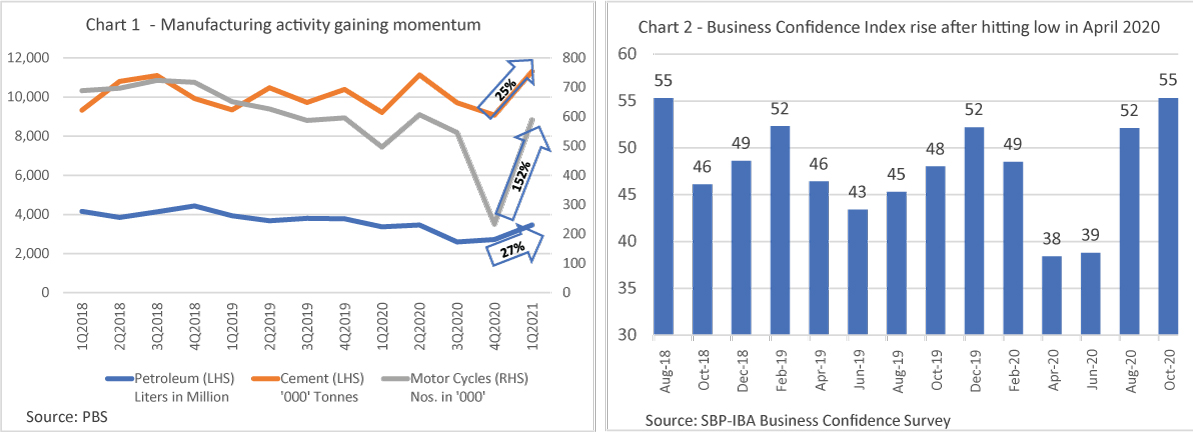

The demand slowdown as a result of the stabilization policies pursued by the government and later on due to Coronavirus-induced economic disruption led to a contraction in GDP in FY20. The economic activity has picked up pace in the recent months, post re-opening of the economy from the lockdown as evidenced by high frequency economic data, such as sale of retail fuels, cement dispatches, and motor cycle sales (see Chart 1). Large Scale Manufacturing (LSM) data also corroborate pick-up in economic activity as the overall output of Large-Scale Manufacturing Industries (LSMI) increased by 4.8% during July-September 2020-21 over July-September 2019-20. The SBP-IBA survey (see chart 2) shows that the overall business confidence level improved further in October 2020 to two years’ high of 55, with the improvement in the perception of both the industry and services sectors.

The external account continued to show improving trend as the current account surplus of USD 382 million was recorded for October-20. It was the 4th month in a row with current account surplus, taking 4-month of FY21 surplus to USD 1.16 billion versus Current Account Deficit (CAD) of USD 1.4 billion in the same period last year. We expect CAD to remain in the manageable range of 1-1.5% of GDP in FY21. SBP’s FX reserves also exhibited encouraging trend that stood at USD 13.4 billion as of November 20th, equivalent to 16 weeks of imports. Despite elevated recent readings, we expect moderation in CPI inflation in the coming months due to high base effect and food inflation coming down owing to improved supplies of perishable food items. The SBP is likely to maintain accommodative monetary policy stance in the coming months with a gradual rise in the Policy Rate from 4QFY21.

Stock market: After a robust 57% rally from its bottom in March 2020, the stock market has depicted lacklustre performance during the last couple of months. In our view, investors have been weighing a near-term resurgence in Coronavirus cases against advancing vaccine development. In addition to this, noise in the domestic politics also weighed in on the market sentiments. Going forward, we maintain our view that the market is well poised to deliver robust returns over the medium to long-run. Our bullish view on the stock market is supported by: (i) improving economic prospects; (ii) attractive market valuations; and (iii) upswing in the corporate earnings outlook. On the Coronavirus front, though the surging infection count is a cause of concern, we do not see major disruption in the economic activity. On the contrary, positive vaccine news reinforces our view of sooner than expected acceleration in global economic activity. While the logistics of production and distribution of the vaccine worldwide are daunting, there is good reason to be hopeful that the end of the COVID-19 pandemic is now in sight.

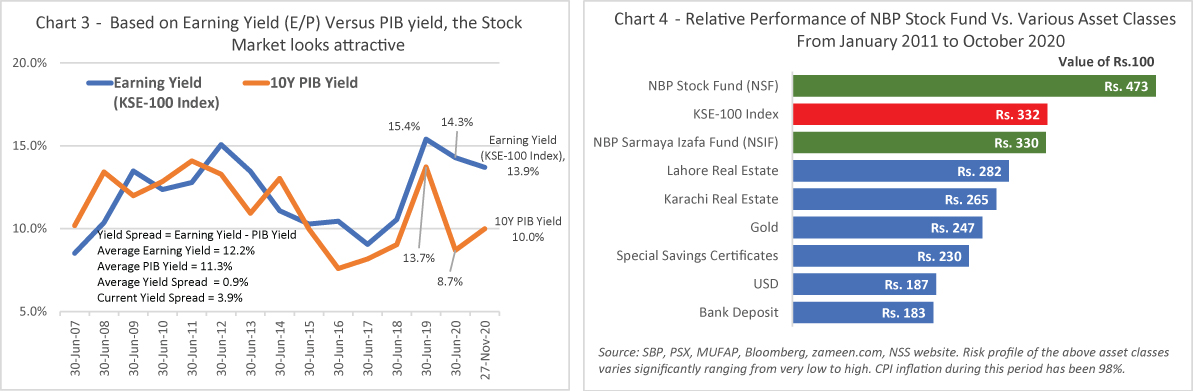

From the valuation perspective, the stock market is trading at an attractive forward Price-to-Earnings (P/E) multiple of 7.2x, versus 10-year average of 8.5x. On a relative basis, the Earnings Yield of 13.9% offered by the stock market also looks appealing compared with a 10-year PIB yield of 10%. The market is valued at P/BV of 1x versus the long-term average of 1.75x. In addition to this, the market also offers a healthy dividend yield of 5.5%. Corporate earnings, the key determinant of stock market performance, are expected to grow at a double-digit rate over the next two to three years, based on our estimates.

To put things into perspective, we have compared the performance of our NBP Stock Fund (NSF) with various asset classes. Zameen.com has been maintaining real estate indices since January 2011. As shown in the Chart 4, NSF has out-performed the stock market and other investment avenues such as real estate, gold, NSS, USD, and etc. An investment of PKR 100 in NSF in January 2011 would be worth PKR 473 by the end of October 2020. During the same period, PKR 100 investment in the Stock Market, Lahore Real Estate, Karachi Real Estate and in Gold would have increased to PKR 332, PKR 282, PKR 265 and PKR 247, respectively. This out-performance of the NSF is net of management fee, and all other expenses.

Bottom Line: We believe that the investment landscape is constructive for equities, shaped by improving economic prospects and attractive market fundamentals. Therefore, we advise investors with medium to long-term investment horizon to ignore any near-term market volatility and build position in the stock market through our NBP stock funds, which have a track record of out-performing the stock market.