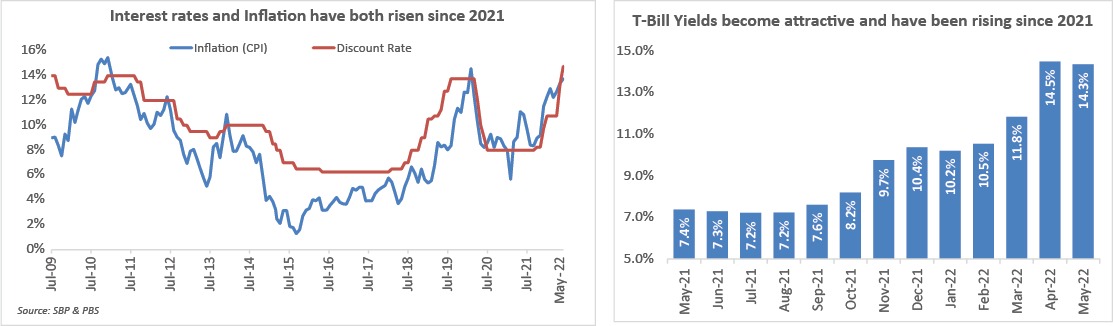

State Bank of Pakistan in its latest Monetary Policy Committee (MPC) meeting has raised the Policy Rate by 150 basis points to 13.75%, taking the cumulative hike during the fiscal year to 675 basis points. The IMF team emphasized the urgency of concrete policy actions, including removing fuel and energy subsidies and the FY2023 budget, to achieve program objectives. Budget related news-flow also points towards further inflation, whereby the government is considering to levy additional taxes on many sectors where it thinks that companies are making abnormal profits. The Government of Pakistan (GoP), in a much welcome step, increased prices by PKR 30 per liter on all range of fuels, as the step ended the protracted policy inaction by the incumbent government.

This is a precursor of other policy measures to follow, and this will also pave the way for the resumption of the IMF program, which is of paramount importance for the country. Faced with an unsustainable stress on current and financial accounts, many unpopular but necessary policy measures have to be undertaken by the government such as continuation of currency devaluation as determined by market-based exchange rate, some further hike in interest rates, complete reversal of subsidies on fuels, gas & electricity prices, broadening of the tax base, and selectively increasing the tax rate. All of these measures, coupled with elevated global commodity prices, will keep near-term inflation high. Thus, further measured hikes in interest rates under an IMF program are a possibility.

Attractive return on money market and income funds: In order to contain the aggregate demand pressure and control the expected rise in inflation, the central bank has aggressively raised Policy Rates by a cumulative 675 bps from 7% to 13.75% in the ongoing monetary tightening cycle. The latest inflation as measured by CPI clocked in at 13.8% for May-22. Worryingly, the Central Bank omitted its guidance in terms of short-term inflationary outlook, though our estimate suggests that due to budgetary measures including rise in utility tariffs & petroleum product prices, and its second-round impact, inflation is likely to rise. Given the current level of the Policy Rate, real interest rate, and inflation trajectory, a further 50-150 basis points hike cannot be ruled out.

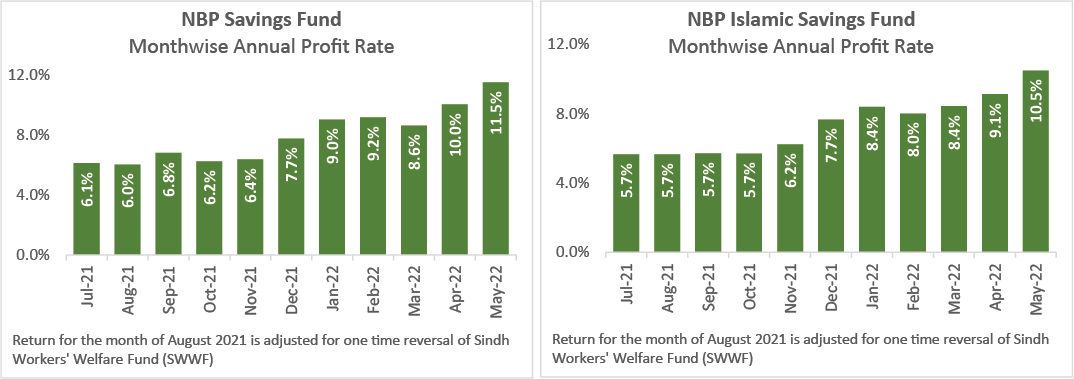

The sovereign yields have responded to the hike in Policy Rate by the SBP as yield on 3-month T-Bills has increased to 14.3% from 7.3% in June 2021. In line with the increase in interest rates, returns offered by income avenues have become quite attractive. Similarly, improving returns along with the added benefits of ease of withdrawal and tax saving have made money market and income mutual funds an attractive option for investors in both the conventional and Islamic categories. They are currently offering double-digit returns. These funds are ideal for investors with low risk appetite, and higher liquidity requirements.

As the above charts show, the return on our income funds have increased accordingly with the increase in the Policy Rate. NBP Savings Fund has offered its investors an annualized return of 11.5% during May 2022. NBP Islamic Savings Fund is a Shariah Compliant Income Fund which has offered its investors and annualized return of 10.5%. If discount rate rises from here, the return on these fund will further rise. These funds are ideal to earn a competitive return while preserving capital by investing in liquid securities. For investors seeking safe and secure double digit returns, we recommend investing in our money market and income funds.

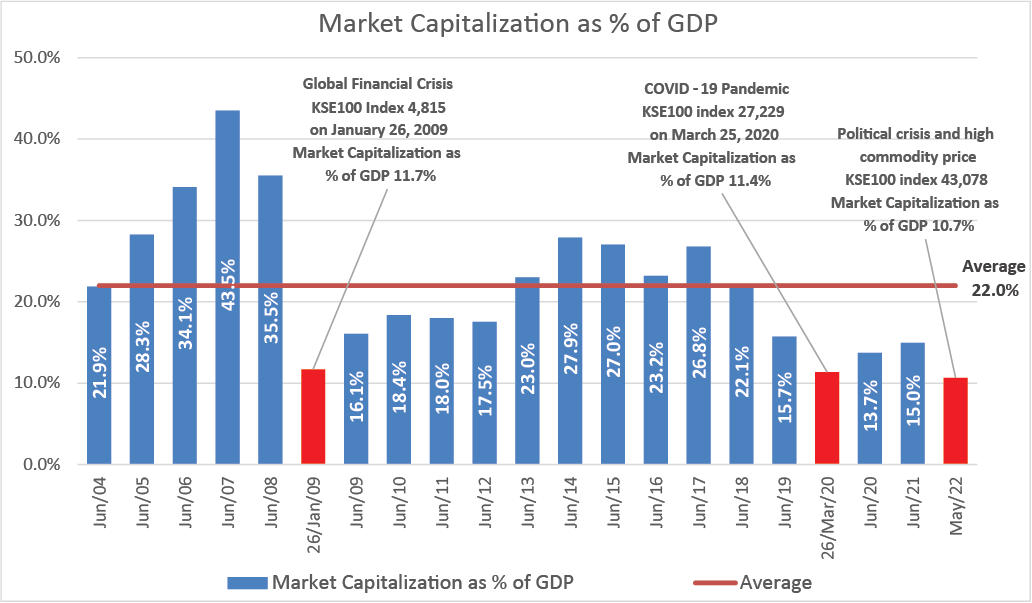

Stock Market valuations at record lows: In terms of stock market outlook, we acknowledge the heightened economic risks arising from deterioration on the external front due to elevated repayments on the financial account in the short term, which is visible from country’s USD bond yields & CDS spreads that have reached unprecedented levels. Having said this, we opine that current stock market valuations more than compensate for the risks highlighted. Any tangible improvement on economic & political front will trigger a strong rally. Therefore, we continue to look favorably towards the stock market in terms of return, whereby we expect the market to provide very good returns in CY22.

Looking at the fundamentals, the valuations of stock market remain inexpensive. Corporate profitability remained sublime in CY21, as cumulative profits rose in excess of 48% on a yearly basis. The companies continue to post robust profitability during the 1QCY22 results, surpassing the previous level of profitability, surging further by around 33% in the first quarter year on year. As a result, the mostly looked at valuation metric, Price-to-Earnings Ratio (P/E) has come down to multi-year low of around 4.3 times (earnings yield of around 23%). The Market-Cap to GDP ratio, has also touched historic low levels, suggesting very small proportion of national disposable income is being channeled towards equity investments. Foreign selling, which was a key reason for market underperformance, has also slowed down significantly, as foreign holdings are now a very small proportion of the total free float. Therefore, given a strong investment case for equities, we advise investors with medium to long-term investment horizon to build position in the stock market through our NBP stock funds.